Electrification strategy and program implementation

Improve your customer relationships

Grow and shape the load

Electric vehicles and electrified buildings are changing the behaviors of the market. How will you shape the load to minimize demand spikes and utilize excess renewable generation? Using our proprietary analytics platform, CO₂Sight, we help utilities visualize programs that create value in an electrified future. Generate demand. Lower costs. Improve air quality. And limit disruption to the distribution system—all while meeting customers where they are.

Electrify while supporting communities

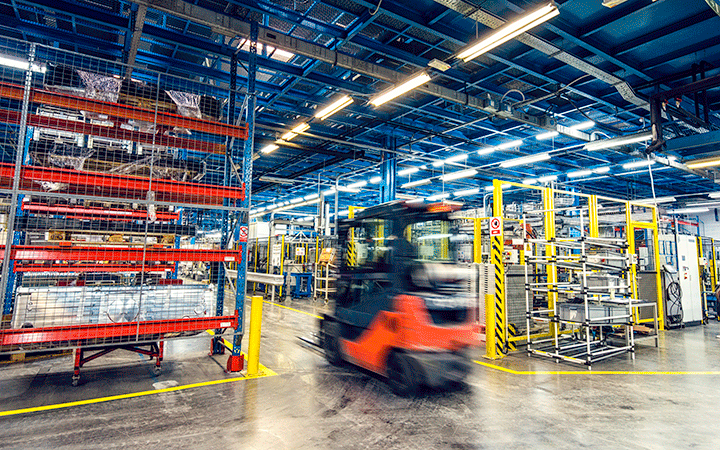

Do the heavy lifting

Commercial and industrial electrification opportunities abound. Converting fossil fuel-powered equipment such as gantry cranes, forklifts, refrigerated trucks, agricultural irrigation pumps, or process heating applications to electric power provides significant emissions and operating cost reductions—while increasing customer satisfaction and energy sales.

Our services

Utility strategy, planning, and program implementation

- Strategic planning

- Regulatory support

- Market and opportunity assessment

- System and locational impact analysis

- Grid and environmental impact analysis

- Cost-effectiveness evaluation

- Technology screening

- Program design

- Program implementation and pilots

- Marketing and outreach

- Program evaluation

Technology sectors

- Electric vehicles

- Fleet electrification

- Residential buildings

- Airport ground support equipment

- Mining

- Marine and port

- Agricultural

- Industrial

- Locomotives

- Ocean-going vessels

- Aircraft

- Commercial buildings

- Material handling

Our work

Featured experts

Related industries, solutions, and services