What can we learn from New York's non-pipeline solutions ruling?

A recent ruling on Con Edison’s non-pipeline solutions (NPS) filing highlights the challenges and opportunities associated with this alternative option for natural gas infrastructure investments.

Economic, environmental, and regulatory concerns are pushing gas utilities to study potential alternatives to traditional supply planning options. Con Edison, National Grid, Enbridge Gas, FortisBC, and other natural gas utilities are being encouraged to explore non-pipeline solutions (NPS) as an option to meet customer needs and provide reliable services.

Regulators have become more comfortable with non-wire alternatives (NWA) to avoid electric infrastructure investments. Now, they are increasingly asking natural gas utilities if traditional infrastructure is the only path forward, prior to approving more conventional investments in gas supply and infrastructure development.

The answer to that question is… it depends.

The specifics of the utility, service territory, peak demand constraints, and rate of underlying demand growth—in addition to the details of the projects under consideration—determine whether or not non-pipeline solutions offer a viable option. ICF has been evaluating these approaches to assess whether NPS represent feasible, reliable, and economic alternatives. While every case is different, a consistent review process will help quantify the NPS opportunity.

The recent partial-approval of Con Edison’s landmark non-pipeline solutions portfolio in New York provides greater context for other gas utilities on how these solutions work, how they are evaluated, and how they might provide both services to customers and solutions to utilities

What are non-pipeline solutions?

NPS are alternatives to meeting on-system natural gas demand. They delay or avoid the need for investment in traditional resources like pipelines, storage capacity, winter-peaking services, and distribution system infrastructure.

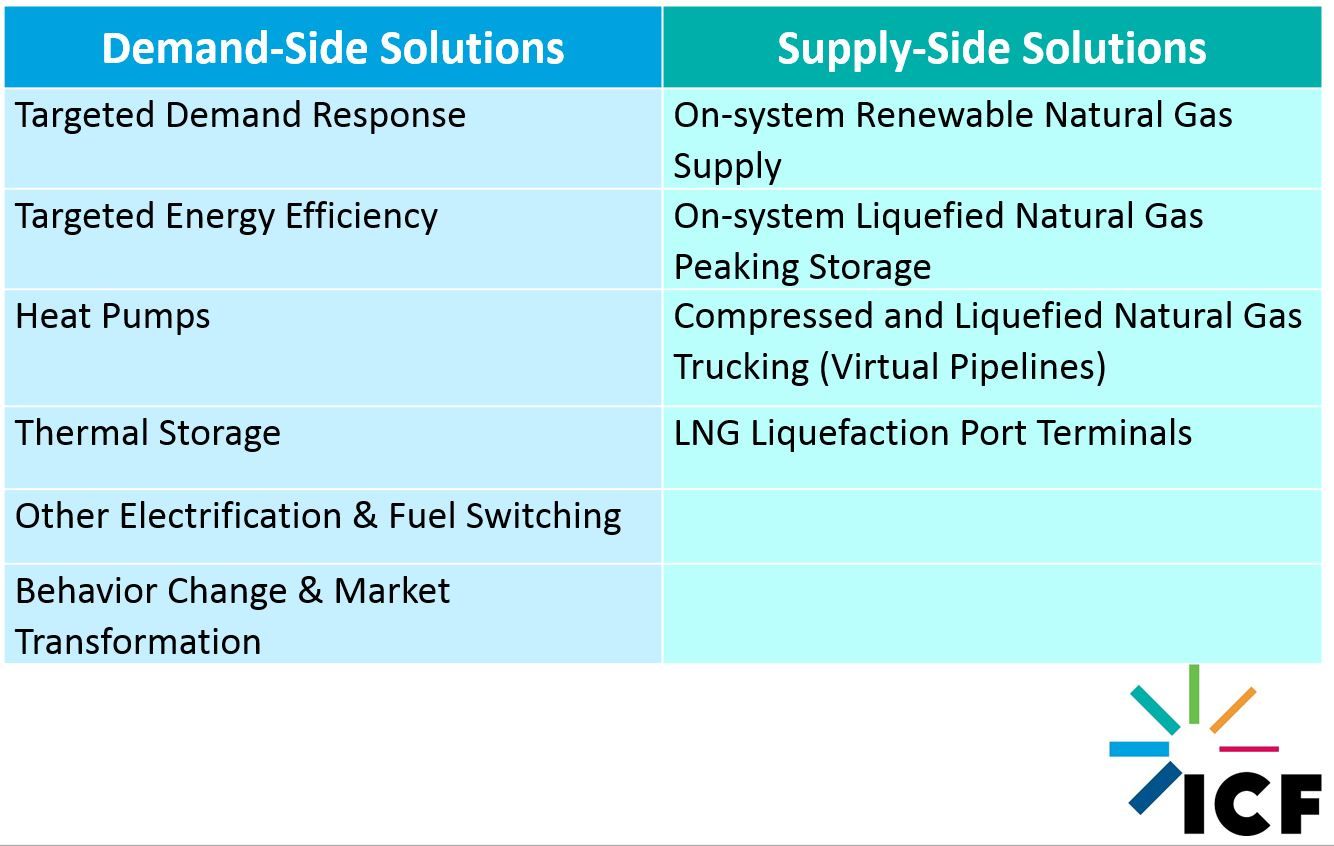

Given the specifics of each utility’s service territory, the nature of their peak demand constraints, and the rate of growth in underlying demand, not all solutions will apply. Examples of possible NPS approaches are included in the table below:

Why are some NPS programs emerging?

Con Edison is at the forefront of efforts to find alternatives to investments in new natural gas pipeline infrastructure, and other gas utilities can learn valuable lessons from its NPS journey.

Con Edison serves 1.2 million natural gas customers, 3.6 million electric customers, and 1,600 steam customers in New York City and surrounding areas. It has gone through a period of rapid natural gas demand growth recently. Their peak demand has increased by 30 percent since 2011, and forecasts predict another 20 percent growth over the next 20 years.

The rise in demand is straining the available capacity on the interstate pipelines serving sections of Con Edison’s natural gas distribution system, making the company reliant on short-term delivered services contracts for more of their peak-day natural gas supply—not an ideal scenario.

To address this growing concern, Con Edison has been evaluating new pipeline contract options to increase capacity into its service territory. However, new pipeline capacity is challenging to develop in New York, and the timing and availability of new pipeline capacity are considered to be very uncertain. As a result, Con Edison is developing non-pipeline solutions to reduce the need for new pipeline capacity.The company faced challenges in contracting for new peak period pipeline capacity, and in developing economic non-pipeline solutions to meet near term load demand reliably. These hurdles led to the January 17, 2019 announcement of a temporary moratorium on new firm gas customers in part of their service territory.

How are NPS programs developed and built?

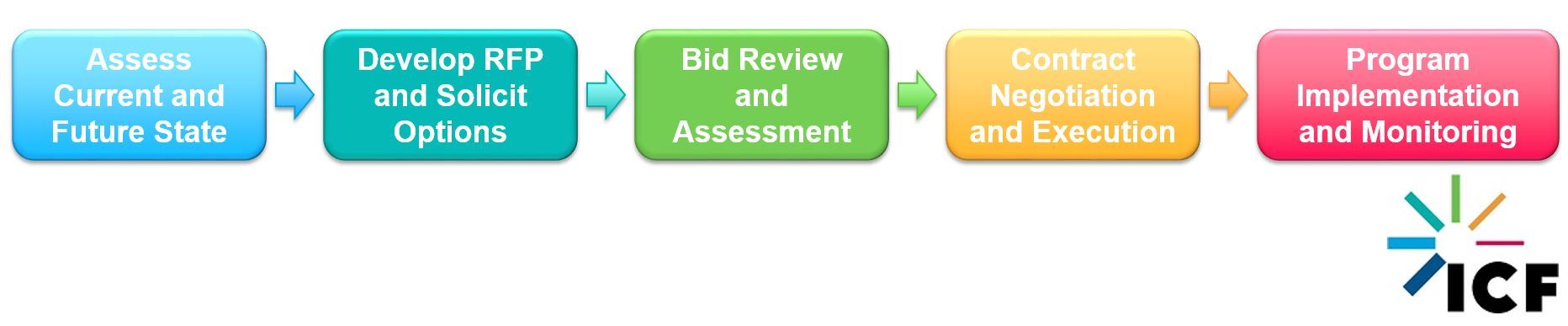

ICF’s recommended approach to quantifying and implementing NPS opportunities varies significantly for different gas utilities, based primarily on the rate and magnitude of system load growth. Incorporating a handful of new measures into existing supply planning will sometimes make more sense than a full new NPS program. But, the NPS program development approach used by Con Edison (summarized in the diagram below) is worth understanding, as it represents one comprehensive pathway from concept to implementation.

Overview of Con Edison’s NPS journey

In December of 2017, Con Edison requested proposals from market participants to provide non-pipeline solutions (NPS) for targeted peak-day relief in key areas. After a thorough review of the proposals received, several rounds of screening, discussions with proponents, and detailed analysis of project impacts on Con Edison’s system, the utility was able to develop a portfolio of NPS projects that met Benefit-Cost Analysis (BCA) requirements.

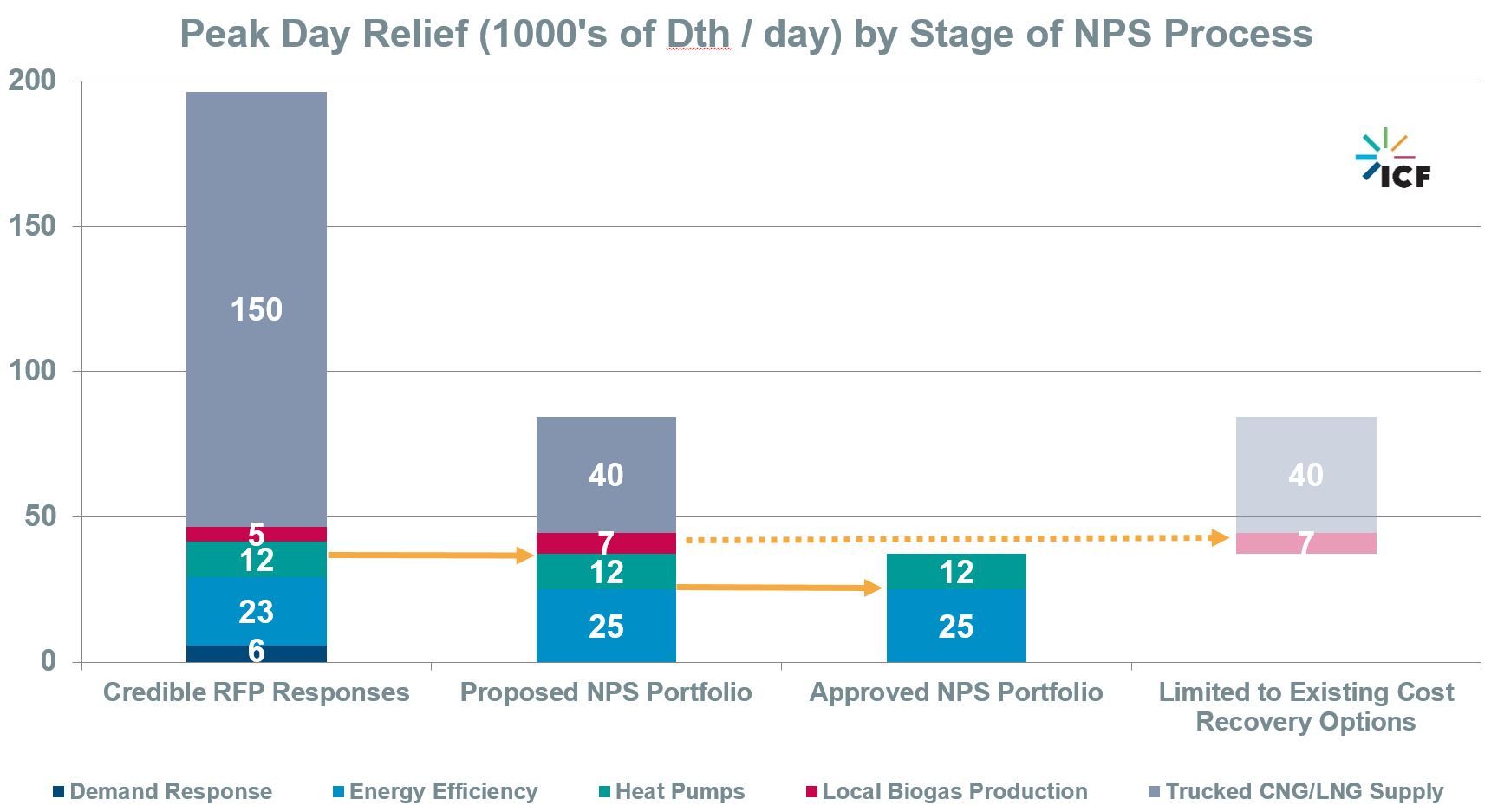

However, the proposal process did not lead to sufficient cost-effective options to fully defer the need for new pipeline capacity. Despite this shortfall, the effort resulted in a $305 million portfolio of cost-effective projects, including a mix of demand-side (energy efficiency and fuel switching) and supply-side measures such as compressed natural gas (CNG) and renewable natural gas (RNG). The portfolio was submitted to the New York Public Service Commission (PSC) on September 28, 2018, for approval.

On February 7, 2019, the commission ruled on the proposed NPS Portfolio, approving the requested $222.6 million for demand-side measures (targeted energy efficiency and electrification). However, the PSC did not approve the special funds requested for the proposed supply-side measures: local RNG production and trucked LNG and CNG.

The commission deemed that, since the portfolio was not able to avoid the need for new pipeline capacity, Con Edison is “exercising its responsibility to maintain reliable service, and costs for those measures will be recovered conventionally under the company’s rate plan or through the Gas Adjustment Clause mechanism, as appropriate and defined by regulations.”

The PSC did not discourage Con Edison from developing these supply-side options but directed the utility to use the current gas supply planning and regulatory approval processes, indicating that no special incentives would be appropriate.

The graphic below summarizes the types of projects and scale of peak day relief at different stages of the NPS process.

Takeaways from the ruling on Con Edison’s non-pipeline solutions program

This order approves a historic launch for Con Edison, in what is likely to be the beginning—not the end—of their NPS journey. But, several long-term gas utility planning issues and questions highlighted by the ruling remain unaddressed.

Con Edison was seeking a shared savings mechanism, specifically a 70/30 customer-shareholder split of expected net savings, and a true-up to actual costs that would split overruns or underruns 50/50. A similar approach is used for electric non-wire alternatives projects, but the PSC did not approve the incentive mechanism in this instance, instead indicating that the existing outcome-based earning adjustment mechanism process would be available for the demand-side NPS programs. The rationale centered on the fact that a pipeline was not actually avoided.

The PSC noted that the “policies of decarbonization and beneficial electrification may create a divergence in the regulatory approaches needed” for gas and electric utilities, which will be a focal topic for years to come.

So, in the near term, where a gas utility has a “specific infrastructure project within the company’s control that can be avoided—the NWA mechanisms may be appropriate.” But for the longer term, gas utilities are “encouraged to propose a more comprehensive and gas-specific approach to incentives for supply constraint solutions” that consider challenges specific to the industry.

The committee also pushed a number of issues into the rate case process, including cross-subsidization between electric and gas benefits related to heat pumps and heat pump incentives.

What is next for non-pipeline solutions?

Non-pipeline solution opportunities will be unique to each natural gas utility, based on the specific nature of their pipeline system, the projected load to be offset, system constraints, types of customers, and jurisdiction. As more jurisdictions consider NPS in the face of high decarbonization goals or constrained natural gas infrastructure, Con Edison’s experience to-date can provide useful lessons learned to other gas utilities. However, Con Edison’s NPS journey is not yet complete, and there are still significant gas-planning considerations to be ironed out for broader deployment.

Join our webinar on March 28th for a more in-depth discussion of the types of NPS that have been considered, how to design programs, how to evaluate portfolios and proposal for services, and the overall potential for non-pipeline solutions in the gas utility space.