How carbon pricing can reduce greenhouse gas emissions

By rewarding low CO2 emitters and making polluters pay for the impacts of the carbon they emit, carbon pricing is a crucial tool to reduce Greenhouse Gas (GHG) emissions. There are a range of tools and climate policy instruments that policymakers have at their disposal, such as carbon taxes, but establishing carbon markets is a cost-effective way to put a price on carbon and at the same time deal with the social and environmental externalities.

In this article, we reference carbon pricing as GHG emission converted to CO2 equivalent. The EU ETS covers all six GHGs:

- Carbon dioxide (CO2)

- Methane (CH4)

- Nitrous Oxide (N2O)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulphur Hexafluoride (SF6)

The EU Emissions Trading System (ETS) was the world’s first major carbon market to enter operation in 2005. The EU ETS works by setting an absolute cap on the total amount of greenhouse gases included in the system, and that can be emitted by the installations from the covered sectors. Those taking part can buy or, in exceptional circumstances, receive emissions allowances for free. (The free allocation safeguards the international competitiveness of industrial sectors at risk of carbon leakage.) They can then keep the necessary number of allowances for compliance purposes or trade with one another if they have a deficit or a surplus. Having faced initial challenges in the first years, the EU ETS is now well established, and another revision round is taking place this year.

The widening impact of carbon pricing

Currently, we’re seeing the role of carbon pricing and ETS widen, with many new initiatives emerging across the world. By relying on and leveraging market forces, ETS has compelling economic merits that make it a cost-effective tool that is being considered in different political systems such as China, UK, EU, and Japan.

Existing compliance markets such as EU ETS are regulated markets. In contrast, voluntary carbon markets (VCMs) are markets where companies and individuals without compliance obligations can voluntarily purchase carbon offsets from sectors that are not yet covered by mandatory emissions reduction regimes. In VCMs, those taking part are involved because they have chosen to do so. VCMs have a role to play, and several ongoing initiatives will enhance, streamline, and increase the robustness and credibility of these markets moving forward. This is important, as it will help to expand the role of carbon pricing beyond compliance markets.

The role of carbon pricing in tackling the climate crisis

The future of carbon markets under Article 6 of the Paris Agreement, especially relevant for the future of the voluntary carbon credits, was discussed at the international climate conference COP27 in Sharm El Sheik, as it is important to ensure that carbon projects developed in developing countries and their respective units are not double-counted and will not overlap with those countries’ own targets and actions towards reaching their respective national goal—the so-called National Determined Contribution (NDC). For further explanation, see Carbon Market Watch COP27 FAQ).

The carbon price tag is crucial—pricing carbon, via ETS, carbon tax, or other measures, is a key requirement to ensure that we stay on course to reach climate targets. The higher the carbon price, the more influential it will be in reducing emissions in industry and decarbonization. If the price of carbon is too low, then it might not have the intended impact.

Carbon Market regulators don’t set the carbon price. Currently, the EU allows the price of carbon to fluctuate in the market and to always be determined by the market—they don't set any lower or higher limits. Instead, they established the Market Stability Reserve (MSR) to manage the volume of allowances in the market. For example, if there is excessive volume in the market, there is a pre-determined rule that might trigger the removal of a certain quantity volume and therefore creating scarcity-increased prices. This also works the other way around: if the quantity of allowances is too low or prices are too high and becoming prohibitive, then the EU can also via pre-determined rules trigger the injection of additional volume into the market which consequently will tend to push the prices down. However, in the early days of the EU ETS there were too many allowances and exceptions for certain sectors and industries and these, combined with the 2008 financial crises and other external factors, brought the price for carbon down to negligible levels—resulting in a breakdown of carbon markets in 2010. Since then, the prices have recovered, ETSs have matured and continuously improved, and they are now being used effectively in more countries, regions, and sectors.

Extending the coverage of EU ETS

Today, we are seeing the positive impact of higher carbon prices, with many more sectors being covered by successful carbon trading systems around the world.

The latest amendment to the EU ETS (currently finetuned during the EU institutions’ negotiations between the Commission, the Council, and the Parliament, the ‘trilogues’) is now further addressing the exceptions that still exist and expanding the scope of the system into new sectors. As a quick overview, here are some of the main ways in which ETS 2.0 will enlarge the scope of carbon pricing.

Amendments include:

- A shift from single source emissions to multiple emissions sources

- Moves to review cap and limit free allocation

- The Market Stability Reserve (MSR), a carbon pricing reform that aims to stabilize prices for installations covered under the EU ETS scheme

The EU ETS initially covered only the largest emitting and energy intensive sectors, where carbon emissions can be more easily measured and brought under the system. However, ETS 2.0 sees an expansion into new areas where there isn’t a single big source of emissions (such as from a single industrial site). Instead, it will also cover emissions from many different smaller sites across a country, often managed by individuals. Monitoring these presents a greater challenge, which is why it is only now being introduced following complex debates on the question of whether or not carbon markets are the right tool for other sectors with multiple emitting sources.

The biggest change from ETS 1.0 to 2.0 in the EU is the currently discussed and controversially debated introduction of buildings and transport, and the limiting of free allowances. In addition, the EU Social Climate Fund will use the revenues from the two new ETS sectors to help vulnerable households to afford to continue to live in buildings and use transport. In this way, the ETS will contribute directly to alleviating the pain of high energy prices. (Editor’s Note: Read more on this in our recent post, How the ‘just transition’ is unfolding across Europe.)

We are also seeing the introduction of the Carbon Border Adjustment Mechanism (CBAM)—the EU’s new carbon border tax. Importers of selected goods (currently aluminum, iron, steel, electricity, cement, and some fertilizers) into the EU will need to buy certificates for the carbon emissions embedded in their goods, as far as the EU ETS covers them. The price of these will be based on the average weekly price of the EU’s ETS carbon permits. CBAM complements ETS with a focus on keeping the EU internationally competitive and incentivizing trade partners to follow up with their carbon pricing mechanisms. The idea is to avoid industries leaving Europe to escape the carbon price and to produce in countries with less strict GHG emission policies and standards. CBAM is now a part of discussions in other countries that are considering the establishment or expansion their own ETS or other carbon pricing mechanisms in line with the upcoming CBAM requirements.

Discover more about ETS 2.0 here.

How can carbon markets contribute to the transformation to a zero-carbon economy?

Carbon pricing is a crucial part of Europe’s journey towards meeting its climate targets.

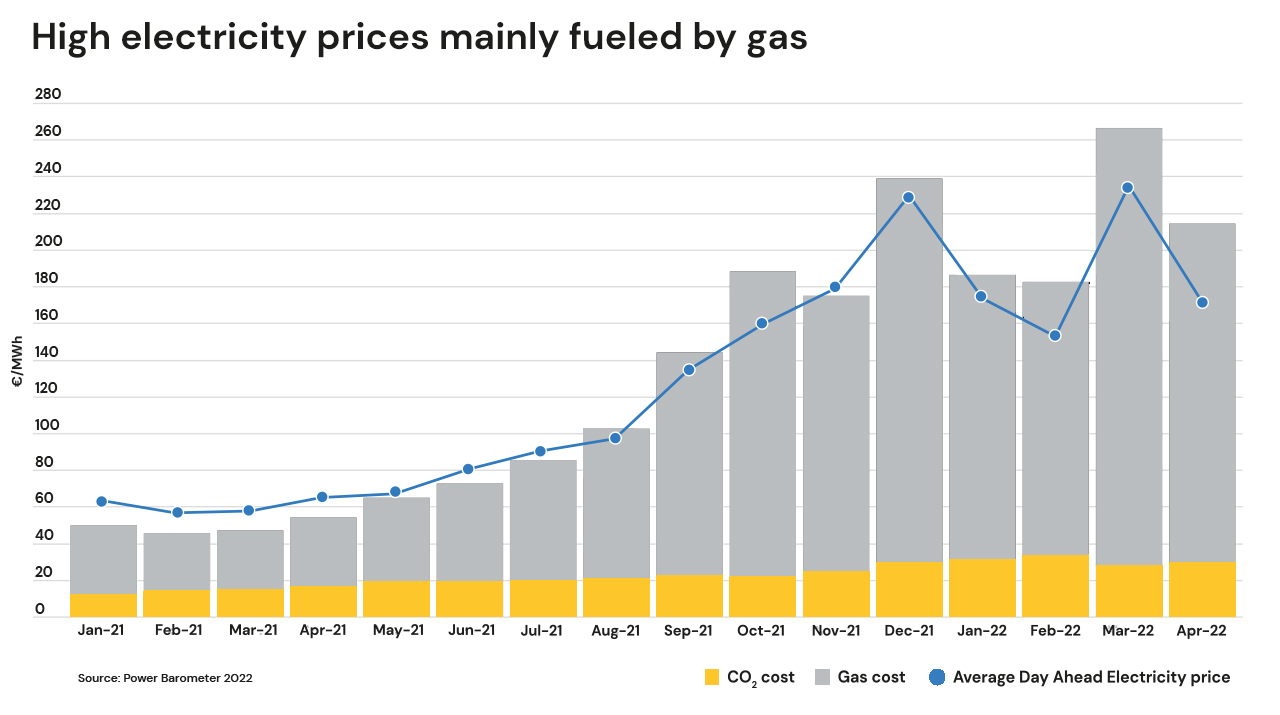

But is also important to note that there is currently a misperception in society that carbon pricing and the ETS is partly to blame for the recent energy price spike across Europe. Carbon pricing is not the reason for the rise, which has been mainly caused by high gas prices due to the disruption to Russian supplies. Carbon pricing is in fact important for raising funds to alleviate the effects of the energy crisis, with support for vulnerable households through the EU Social Climate Fund.

The expansion of ETS into other sectors is also far from straightforward, as some (e.g., buildings and transport) are already covered by policies such as taxation. Any changes to the EU ETS need to ensure that there is no double coverage—for example by a carbon tax being introduced into an ETS sector, or vice versa.

These challenges withstanding, the hope is that having a price on carbon will ultimately also have an influence on individual behavior. We are already seeing how individuals are changing their own energy use through simple actions such as turning down the heat, installing solar panels on their roofs, or switching from conventional cars to electric cars or public transport to get to work. Complementary to large scale economic instruments such as ETS, smaller scale changes on the part of individual consumers are described in our article: Living below 1.5°C: A guide for European citizens, businesses, and policymakers.

At ICF, we are pragmatic in our approach to carbon pricing. We know that carbon pricing, in general, and ETS, in particular, is an important tool in the toolbox of climate mitigation measures. We have learned valuable lessons from the work we have done on the China ETS, the Korean ETS, our work advising the government of Ukraine and training the Brazilian government on ETS and our work with the aviation sector relevant to CORSIA. And in the current conditions, we see it as tool for channeling investment in future growth and development.

This is why getting carbon pricing right is so crucial—because while challenges such as rising energy prices have a severe, short-term impact, carbon prices will be even more significant, both for the future of society and our planet.