Exploring fuel prices and the other factors behind aircraft values

There is consensus within the aviation community that external factors like jet fuel prices, interest rates, and overall economic environment are key factors in most industry decisions. However, do you understand how these external factors can influence an aircraft's value?

Watch the webinar to explore:

- The challenges in establishing aircraft and engine values.

- Our thinking behind various external factors and how they impact value.

- How to form a market-based determination of aircraft value.

Transcript

Stuart: Afternoon. Good morning. Good evening. Thank you all for joining us on for this webinar, produced by ICF and CAPA jointly, talking about fuel prices and other factors behind aircraft values.

I'm Stuart Rubin, the leader of the Aircraft Sector at ICF Aviation. It's the organization within ICF Aviation that does all of the asset valuations, both tangible and intangible, as well as maintenance, cash flow, forecasting in supported ABS transactions, tactical asset management, and advisory for investors that are looking to get into the aircraft leasing space and other related due diligence assignments. I've been with ICF now for six years. But my experience in asset valuations spans nearly 20 years. I'm an ISTAT Senior Appraiser and have experienced valuing all types of aviation assets, from light twin helicopters all the way up to large commercial wide-body jets.

Lori: My name is Lori Ranson. I am a Senior Analyst for the Americas at CAPA Center for Aviation. I cover developments in North and South America in aerospace and aviation and look at how those developments affect all stakeholders on a broader scale.

Stuart: We're gonna cover a couple of key topics:

- The challenges around establishing aircraft and engine values, a little bit about how we do it in ICF.

- Some external factors that we look at and how they impact values of commercial aircraft.

- Some of the methods we use in the determination of aircraft value.

Challenges in establishing aircraft and engine values

Stuart: Over the last few years, aircraft manufacturers have introduced a number of newer updated aircraft programs. It's certainly a significant number and probably within a relatively short span of time, in my view, it's a really high number of new programs. One of the frequent questions I get is how do you appraise a new aircraft if there's no transaction data to guide you with respect to aircraft value? What method do you use? It relates to one of the most challenging, but also interesting, aspects of our appraisal work. There's no industry-wide public source of commercial aircraft transaction data. It's not like real estate values in the United States, where you'd look at tax records or look up appraised values by municipality and find out what the last sale price was of a residential home.

As a result, we in ICF have to leverage our networks of contacts to get data and intel on aircraft prices. The transaction information that we get from our sources is highly proprietary and extremely confidential. It's a snapshot in time, and therefore may represent a small slice of all transactions especially for those aircraft that tend to be less liquid. Although it's hard, transaction data is the most reliable source of intel.We have to rely on other information, such as anecdotal information, observing, changing industry dynamics and other economic data points.

At a high level, that means that we have to take on multiple approaches to determining values for ICF's Truebook online valuation platform based on the information that we have available.

Mature platforms

Stuart: For mature platforms that tend to be highly liquid assets like 737NGs or A320neos, or, CEOs, [SP] excuse me, there's usually sufficient transaction data in the marketplace to employ a market comp approach.

We will look at other factors such as market mass, which is the number of aircraft in service at an order, as well as the number of customers. We'll also look at where the aircraft is in terms of the market segment it's in. Is it a segment that's in heavy demand, in heavy use? Is it a segment that's not as active? And then based on the data received on the more popular types of a family like A320 or 321 or 737-800, we can interpolate across the spectrum of vintages to develop values across the spectrum, and then also to develop values for less popular family members like the 737-600 or A318 to give some extreme examples.

For the earliest vintages of the aircraft in these aircraft families, we're able to create regional market values by using our proprietary parts database to estimate the values for run out airframe and engine though that would support a value floor if you will, for the aircraft which essentially the lower bound of the aircraft value based on the sum of the airframe and engines as in a part out scenario.

New platforms

Stuart: For newer platforms, information on transactions is usually more limited. We rely more heavily on a cost-benefit analysis that takes into account information from OEMs on maintenance costs and fuel efficiency improvements and other efficiency improvements that the new aircraft is going to provide over an existing platform.

We'll estimate normalize seed counts to determine the delta to the current program to ensure we're doing an apples to apples comparison. And we'll also look at things like market match to the aircraft, as well as the segment the market the aircraft functions in, to help guide our value opinions. Again, aircraft that are gonna be in active segments where there's a lot of demand, that will guide us in one way or the other on a value opinion. As a result, we're able to estimate aircraft values before large volumes of market transaction data is available.

Assets under lease

Stuart: For assets that have a lease attached, ICF will employ a lease encumbered or securitized value which takes into account the rent and term of the lease, along with the aircraft residual value which may be adjusted for a minimum or assumed condition of time of lease expiry inappropriate discount rate for the transaction. For some aircraft types where we've seen, where we've been valuing, where transaction data is limited or non-existence, such as special mission aircraft, we'll value the aircraft based on its revenue generating capability and employ a discounted cash flow analysis.

There may not be a singular right way to value an aircraft, but we feel that the best approaches are ones that use a combination of these methods.

Factors impacting aircraft value

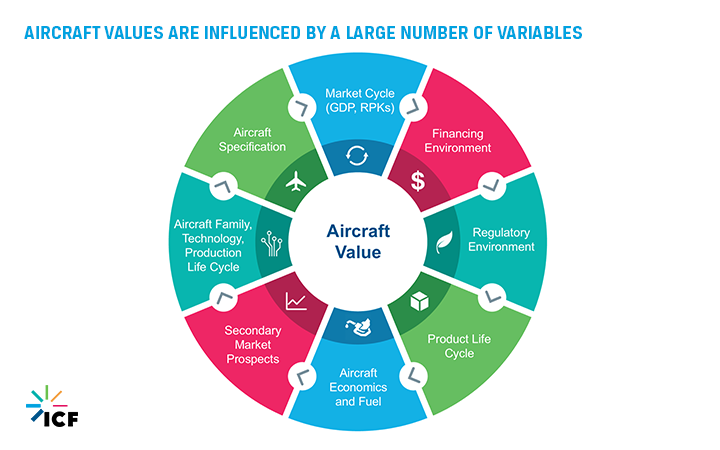

Stuart: We really can classify both external factors that impact aircraft value to external or general market macro factors, and then more micro factors which are more specific to an aircraft.

Stuart: The macro factors start at the 12:00 position. And as you rotate clockwise, go into the more aircraft, MSN aircraft type or MSN specific factors.

So, you're looking at things like the market cycle, where we are, are we in a growth cycle or are we in a softening stage? We look at the financing environment. Right now, we're in a very low-interest rate environment. So, financing new aircraft has been relatively cheaper than historically. It’s made that segment quite attractive. The regulatory environment, are there age importation limitations or other regulatory factors that may impact demand of an aircraft or supply? Where's the aircraft in its life cycle? Aircraft that tend to, aircraft that are delivered at the end of a products' life cycle tend to hold their value, do a poor job of holding their value, the aircraft that were delivered in the middle earlier part of the life cycle.

Relative aircraft economics and fuel

Stuart:Secondary market prospects, that goes to what we call market mass. So, is the aircraft part of a large fleet with a broad operator base which affords multiple follow-on sales opportunities, or is it somewhat tighter? Are there...is a much narrower base of operators that are able to employ or deploy the aircraft? We also look at aircraft family and technology level. Is there a...there's I think what we've seen in the past is that there's an advantage to having, being an aircraft, having an aircraft that's part of the family. It reduces spares, stocking costs, and crew training costs.

And then, as we get down to aircraft specification, aircraft that have higher takeoff weights or higher engine thrust ratings tend to have more capability, more range. So they tend to be valued at a higher level. I'm gonna turn it over to Lori for the next couple of slides to talk about some of the other factors that we're seeing in the marketplace.

How GDP impacts aircraft values

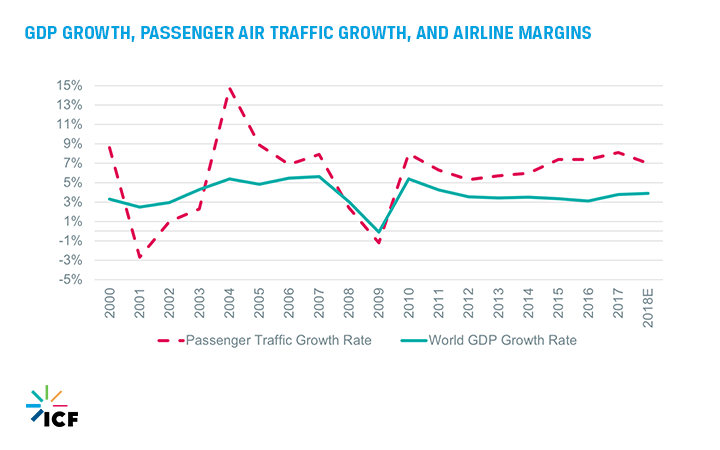

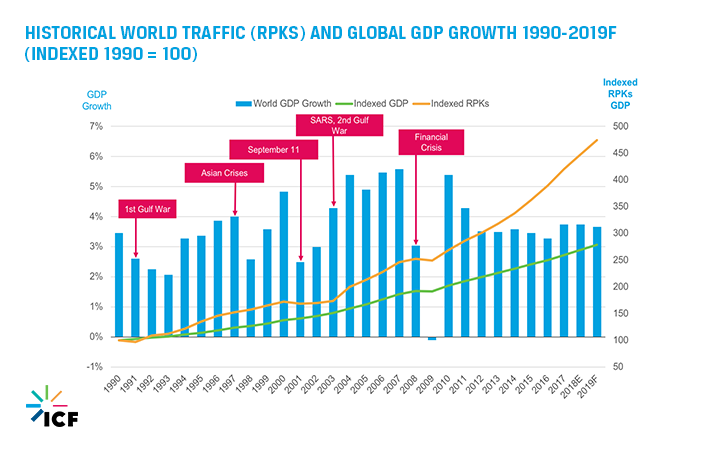

Lori: Since about 2000, RPKs have grown at about 1.3 times world GDP. And as a result, while GDP has nearly doubled during that time periods, RPKs have almost tripled.

Lori:You can see some sort of growth and external shocks that happened in the industry from about 1990 to 2019. One positive trend is the general resiliency of the aviation and aerospace industry, which overall has rebounded pretty nicely from some of these external shocks. The first Gulf War, Asian crisis, the terrorist attacks in September 2001, the second Gulf War, and the financial crisis.

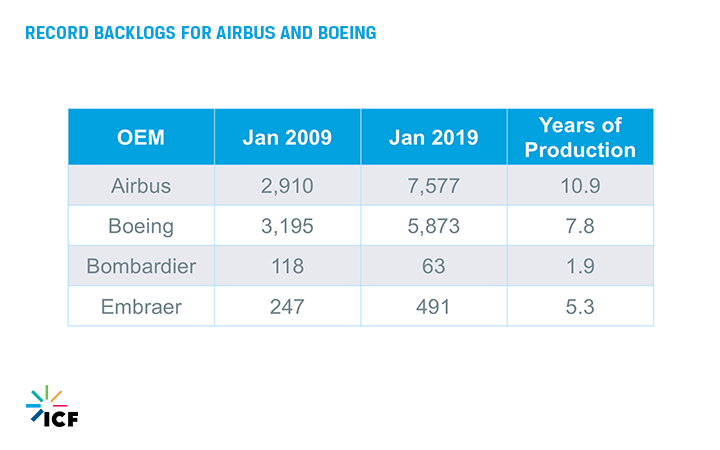

Air traffic since the financial crisis has climbed significantly. And that economic expansion along with the timing of introduction of new aircraft programs has created record backlogs for Airbus and Boeing.

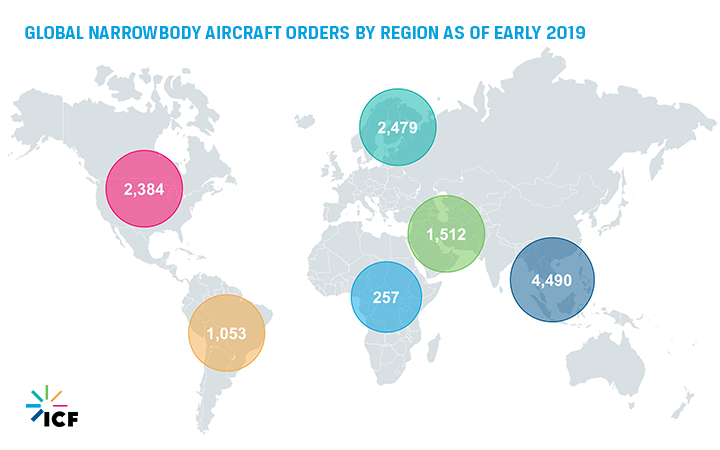

Lori: At the beginning of 2019, the world's two largest commercial aircraft manufacturers had more than about 13,000 aircraft on order. Airbus and Boeing are both aspiring to push their narrowbody production rates to about 60 aircraft per month later this year.

The Airbus orders include the A220, which many of you know was the previously the Bombardier C-Series,was rebranded last year once Airbus finalized its majority stake in the program. If and when Boeing and Embraer finalize their agreement, there Airbus-Boeing commercial aircraft monopolies are only gonna become more robust, with product offerings ranging from the smallest narrowbodies to latest generation widebodies.

One thing to watch out for during the next couple of years is how the strengthening of that duopoly will affect the supply chain. If any consolidation or further consolidation amongst suppliers is gonna continue.

Lori:Breaking narrow-bodied orders by a region, it's not surprising that Asia-Pacific represents the bulk of those orders, particularly for narrowbodies.

IATA projects a market size of 3.1 billion passengers traveling to, from, and within Asia-Pacific by 2035. And China's set to replace the U.S. as the world's largest aviation market by 2024.

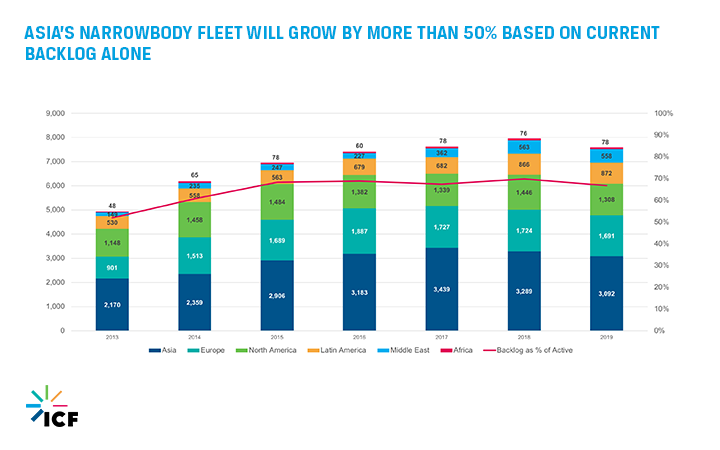

Lori:This chart shows that narrow body orders for Asia-Pacific jumped roughly 53% from 2013 to 2019. For Asia-Pacific, demand for a narrow-body aircraft is being driven by traffic growth. Those orders represent about 59% of the active fleet. Based on current backlogs, Asian air-body fleet is gonna grow by more than 50%.

In more mature markets like North America and Europe, narrow-body orders are much more tied to replacement cycles, not surprisingly.

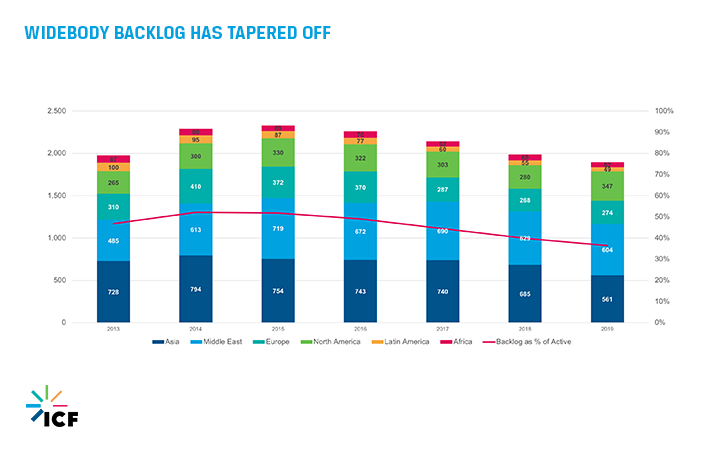

Lori:That's largely due to the replacement cycle for those aircraft reaching a certain level of maturity, but it's also timely. It's worth mentioning that the recent cancellation of A380 is interesting.

It shows that airlines are generally moving to the direction of smaller wide-bodies. Emirates decision to shift A330s and A350s results in the A380 backlog standing at about 40 aircraft currently versus 655 for A350s and about 760 for the 787. This actually sort of reflects a trend that has been around for almost 20 years. If you think about the first aircraft that were parked after the September 2001 terrorist attacks, the majority of those aircrafts were large wide-body jets.

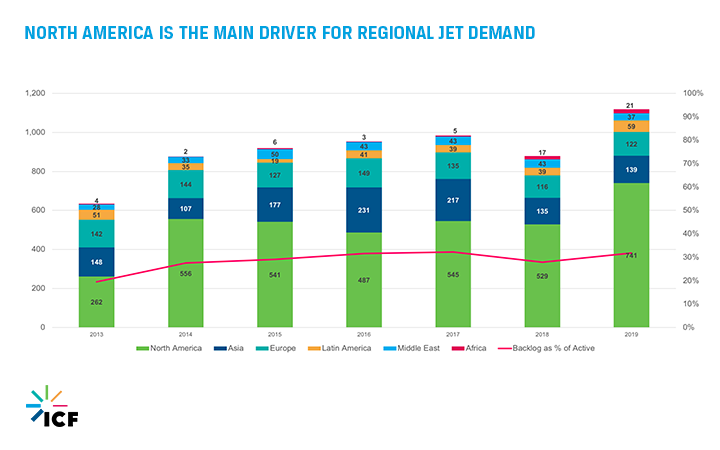

Lori:Mainly as those operators look to replace their older, inefficient 50-seat jets with larger 70 to 76-seat jets that feature two classes to drive up their revenues and largely improve the customer experience as well.

One thing to think about is another factor that drives record orders for a narrow-body aircraft is market penetration for air travel in emerging markets remained very low.

This shows the trips per capita for countries in emerging markets such as Brazil and China versus a more mature market like the United States. You can see the opportunity for traffic simulation in those emerging markets. But, against that backdrop of opportunities for traffic simulation, there are obviously some near-term challenges.

How those headwinds can factor into market values

Stuart: The economic expansion of the last nearly decade can't continue forever. Certainly seeing some challenging signs. In Chinese industrial production growth has been slowing. There's continues to be lingering questions on how Brexit will be resolved in Europe. And then, we have the specter of continued trade protectionism as a result of a more muscular attitude in the United States. All of these factors I think are fueling market uncertainty.

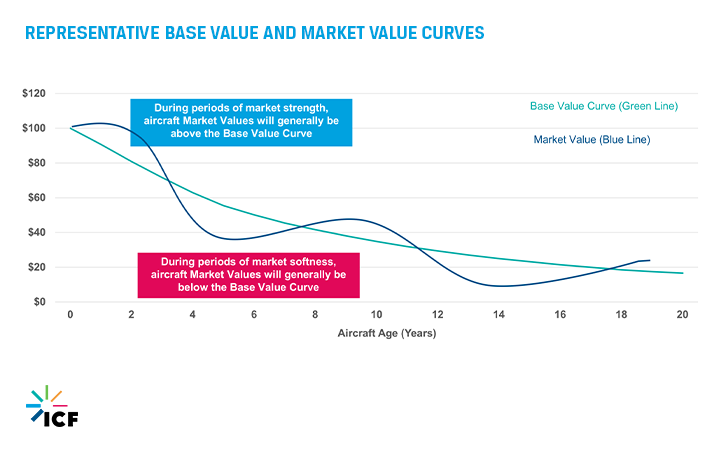

We've seen some recent airline failures in Europe, notably Germania [SP] earlier this month, as well as some profit warnings from normally robust carriers such as Ryan Air. Right now, ICF has most aircraft values above the base value line reflecting a strong market. But our view is that we think a correction is due sometime in the next 12 to 24 months. And potentially into this future correction, the OEMs are going to be delivering an increasing number of aircraft, particularly narrow-bodies. So, this will likely put downward pressure on market values.

Stuart: Just to give you an illustration of this, I've plotted base value on this chart here, at new the value is 100. Over time the base value which is the value of the aircraft in a neutral market, supply and demand are equal, market conditions are reasonably in balance, the value of the asset is gonna decline at a steady rate. If we overlay the market value, which will show up as a sine wave on the chart, as the market moves through the cycle times of strong demand, their market value is above the base value line. In times of weaker markets, softer markets, the value is below the base value line.

Financing environment's role in influencing market values

Interest rate

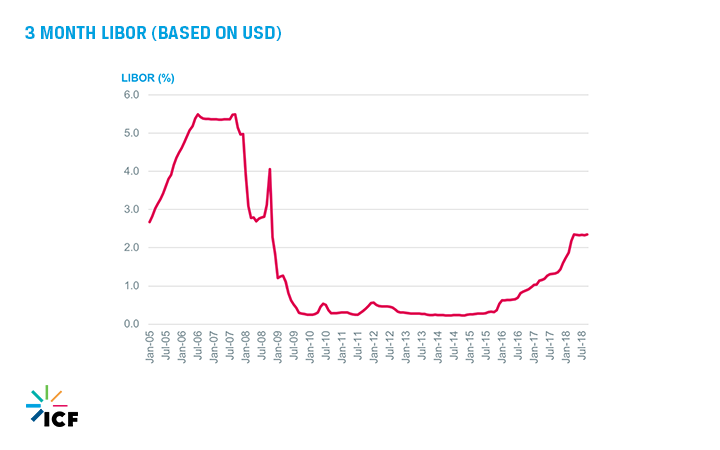

Stuart: We've been in a historically low-interest rate environment for about 10 years. These low-interest rates have made new aircraft less expensive to finance. That's helped contribute to the significant rise in firm order backlogs for new aircraft, but we've seen some recent interest rate rising. As the interest rates rise and borrowing costs will increase,this will have a knock on effect of lowering aircraft values and possible reduction in access to capital markets.

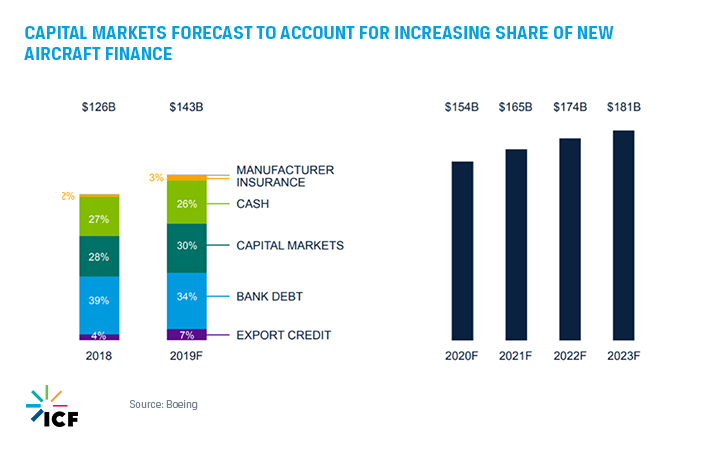

Stuart: Given the flow of new deliveries for 2019, and this data is sourced from Boeing, Capital Corporation's forecast, they're forecasting $143 billion in finance requirements for commercial aircraft for 2019, for new aircraft. While the vast majority is still going to come from the three biggies, cash, capital markets, and bank debt, we have seen some increase in potential export credit requirements. I think, again, reflective as some of the softening in the marketplace where ECAs are gonna be in a bit more demand for as we go through the market soft from period.

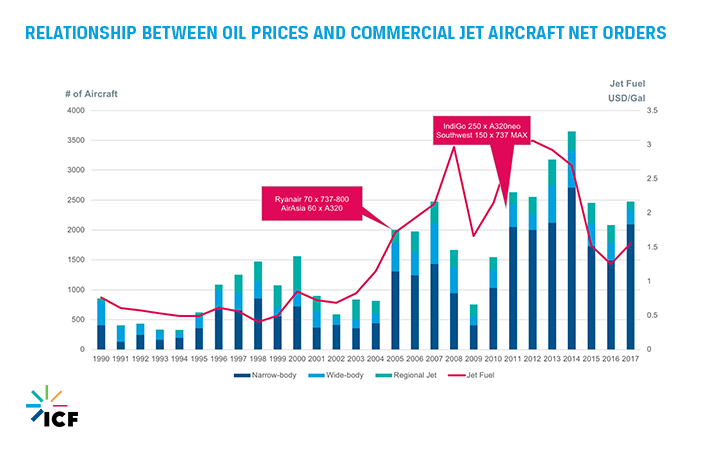

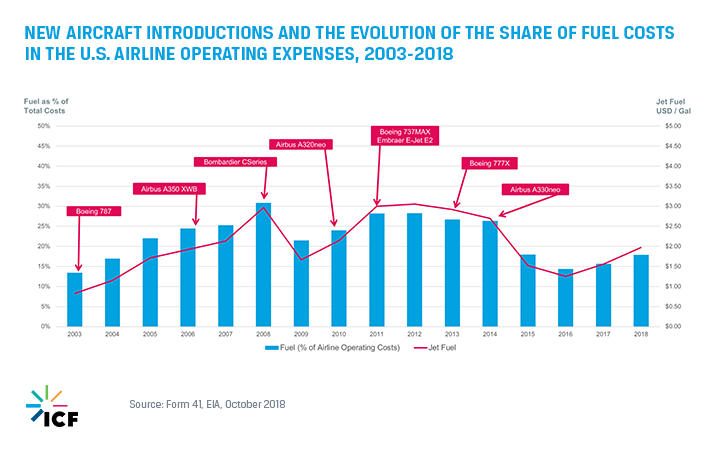

Lori: This shows the relationship between large aircraft orders that replaced when fuel prices were high and orders have slowed recently as fuel prices have dropped over the last few months. Note a spike in aircraft orders from 2005 to 2007 and between 2011 and 2014. Those were largely driven by narrow-body orders following the introduction of the A320neo and the 737 Max. And also just notice a jump in wide-body orders in the 2007 time period.

Lori: It's pretty interesting to see sort of the fuel price curve and when new aircraft programs were introduced. Most of the new generation aircraft were introduced during a pretty high period of rising fuel costs.

One thing to think about is if aircraft production delays, lower fuel costs, and lower ownership costs have created opportunities for current operators to extend the life of current generation aircraft, particularly narrowbodies.

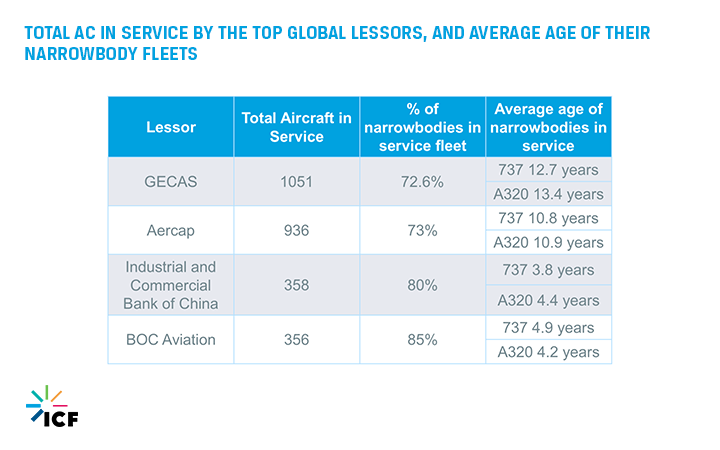

Lori: There are various definitions of a midlife aircraft that range from 8 to 16 years. This is a snapshot of the top global aircraft lessors.The top two have narrow bodies that fall into that range.AerCap has calculated that the average age for all of its current technology aircraft is about 10 years. It's confident those jets will be in demand for the next 12 years, which will consume the remaining economic value and reduce any impairment risk on those assets.

AerCap also believes that younger variants of current technology assets could face some residual risk because, in about 12 years, those aircraft are gonna be replaced in large numbers by new technology assets.

U.S. lessor Air Lease has concluded that strong global passenger growth, continued aircraft replacement needs, and production delays are causing some affected airlines to extend current leases or add additional current generation aircraft.

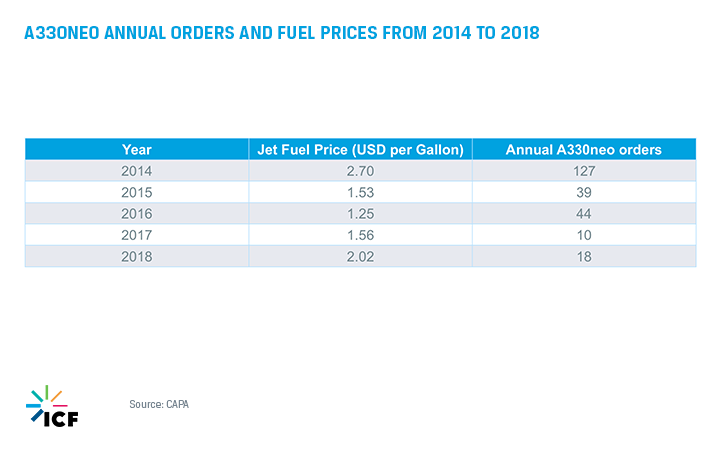

Stuart: This just shows an interesting specific case study of the relationship between fuel prices and aircraft orders of the A330neo. Orders did fall as fuel prices declined, even as Airbus was presumably offering discounts for the A330neo to compete more effectively with the 787.

2018 A330 Developments

Stuart: There were some interesting developments in 2018 specific to the A330neo. Hawaiian cancel orders for six A330, 800neos and it was the only customer for that variant.

But at the same time, Delta has altered its Airbus order book. It added 10 A330neos for a total of 35 and pushed back deliveries of 10 A350s. Air Canada has also opted to keep eight A330 current generation wide-bodies. And it's interesting because Air Canada evaluated exercising options for additional 787s versus investing in A330 refurbishment. Refurbishing the older aircraft was better business case and Air Canada has stated that they're not always gonna lean towards spending the capital on brand new aircraft.

The CEO recently said, "We'll have a business analysis to sort of say what the best approach is." This is particularly interesting because Air Canada just recently completed a wide-body fleet revamp. The 777 and 787 are essentially the backbone of its fleet.

Delta is using its A330-900neos to replace some of its 767-300ERs. As of late 2018, they had about 56 300ERs in its fleet. Delta has stated that the A330s have 50% more premium seats than the older wide-bodiesnd has also calculated that the aircraft have 22% better fuel burn per seat. Delta has also said that it's looking for 757 replacements, and it's expressed an interest in being our launch customer for Boeing's middle of the market aircraft. Delta usually shies away from being an aircraft launch customer. So it's really interesting that it said, yes, and going forward raising his hand saying we would like to be a launch customer for this aircraft, which could be named 797.

What's the market for the 797?

Stuart: This shows that they're about more than 350 passenger variants of the 757 in service today, out of a total of 700 in-service aircraft. Most of the replacement opportunities for Boeing's potential new middle of the market aircraft are in North America because that's where 757s are concentrated.

Stuart: But Boeing has stated that it's discussing the aircraft with roughly 60 customers worldwide.

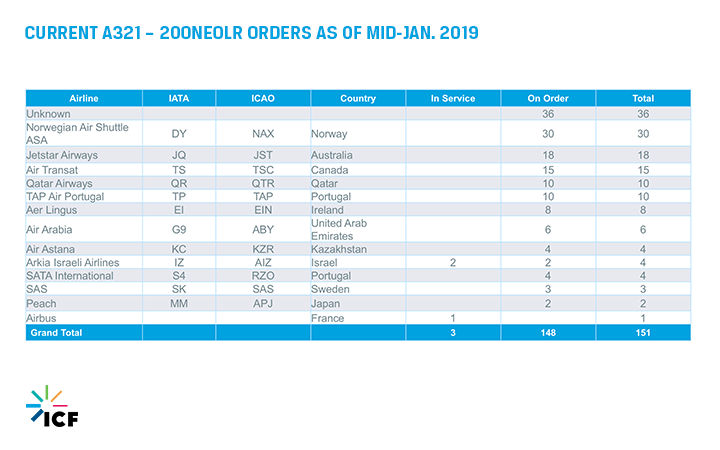

Stuart: Most of the orders for the A321neo LR, which Airbus touts as a 757 replacement, they're largely from airlines in Europe, Asia, and the Middle East. This is just sort of a brief snapshot of some of the developments in the aircraft order cycle and how an individual airlines' needs kind of factor into business decisions, digging down a little bit deeper in terms of how they think about their fleet regarding new and used aircraft.

Methods used in the determination of aircraft value

Stuart: I'd like to walk you through some of the thinking we did around calculating our value premium for the 737 max family. what we've done is we've looked at the NG to max value premium. What we did was we normalized the seat count for each aircraft in the segments. So we looked at 700, 800, and 900ER corresponding Max-7, Max-8, Max-9.

We pulled the block fuel for a typical airline mission, standardized the trips per year and then calculated the fuel burn per year. And then based on the OEM data on fuel efficiency improvements, we calculated what the reduced fuel burn was gonna be and then calculated that based on...calculated that reduction based on a, I believe it was a $2.50 per gallon fuel price.

So we have that fuel cost saving per year. We use a present value analysis over 15 years at an 8% discount rate, which gives us our PV to annual fuel saving. And we make the assumption that half of the benefit is gonna go to the OEM, half the benefit is gonna go to the operator. So, our fuel premium is one half of the annual fuel saving. In addition, with respect to maintenance costs, they're based also on OEM estimates that we've calculated based on the cost per flight hour. So that gives us our PV of annual maintenance saving.

And then, we get into PV back under the same calculation, 15 years, 8% discount rate, half of it going to the OEM, half that going to the operator. So you combine the two premiums and get to the, provides us our max value premium. But it's important to note that this is our process for the initial analysis. And once we see more and more transaction data, as more and more of these aircraft come into the market, our value premiums for the new aircraft can and likely will be revised as we see more and more data.

Stuart: We've plotted the values for the NGs and the CEOs based on the normalized seat count. And the slide shows the value shift for the new platforms on a seat count basis. What you'll also notice is that the larger aircraft get a slightly higher premium given the increase fuel efficiency benefit for these types. And that's the...that wraps the webinar. If you have any questions regarding the presentation, please contact myself or Lori.