Driving clean freight: Enabling India’s transition to zero-emission trucking

Every day, millions of trucks crisscross India’s highways, delivering the goods that power our economy, but also leaving behind a heavy carbon footprint. India’s path to net-zero emissions by 2070 depends on how it tackles one of its most overlooked challenges: decarbonizing road freight.

Road freight vehicles are indispensable to India’s economy, delivering food, fuel, and finished goods across a sprawling geography. But they’re also deeply polluting and energy-intensive. India’s trucks, though only 3% of its vehicle fleet, account for 53% of the transport sector's particulate matter emissions and 34% of transport-sector CO2 emissions. With freight demand expected to grow fivefold by 2050, the truck population could quadruple to 17 million. Without a shift to cleaner vehicle technologies, freight-related emissions are expected to double, threatening climate goals and air quality.

Potential impacts from freight-related emissions

The urgency is not just environmental. Freight trucks contribute heavily to urban air pollution, especially around logistics hubs and industrial corridors. Diesel exhaust is a known carcinogen, linked to respiratory and cardiovascular diseases, posing significant public health risks. In addition to the human cost, this pollution leads to substantial economic losses through increased healthcare burdens, reduced labour productivity, and damage to air quality compliance in cities.

The fiscal impacts are also enormous. Road freight accounts for over 25% of India’s annual oil imports, making the economy vulnerable to price shocks and geopolitical risks. Decarbonizing freight could potentially save ₹116 lakh crore (~$1.5 trillion USD) in oil costs by 2050. The transition to zero-emission trucks (ZETs)—powered by batteries, green hydrogen, bio-CNG or LNG fuels, or even overhead electric (e-highway)—makes a compelling economic case towards decarbonization of freight.

Freight decarbonization also brings broader socio-economic benefits. India’s transition to clean freight can create green jobs in EV manufacturing, battery technology, and infrastructure development. It can also improve urban air quality, especially around industrial zones and freight hubs, and enhance energy security by reducing dependence on oil imports.

With growing momentum across policy, technology, and industry, decarbonizing freight is no longer a distant goal; it’s a practical step toward building a healthier economy and a more resilient future. The rest of this article explores how India can make this transition happen: what’s already underway, what challenges remain, and what actions can help accelerate progress.

India’s policy foundations for clean freight

The Indian government has taken early steps to green the freight sector. Key initiatives are shown in Figure 1.

These early steps show that India is serious about cleaner freight. A unified national roadmap with clear regulatory, financial, and infrastructure commitments can be the foundation for a much larger transformation.

Technology pathways for clean freight

India’s road freight ecosystem spans everything from small intra-city delivery vans to long-haul heavy-duty carriers. Each vehicle category is designed to meet specific operational needs based on route length, payload, duty cycle, and refuelling constraints. The viability of ZET technologies depends on how well they align with these operational use-cases. A one-size-fits-all approach won’t work. Instead, strategic deployment must be tailored to match technology with context:

- Short-haul use cases: These routes, typically covering 150km–200km per day, are predictable, operate in urban environments, and allow centralized charging, making them ideal for battery-electric trucks (BETs). High-capacity battery packs and lighter-weight fuel cells can also be explored in these cases. Examples include e-commerce logistics, port-to-warehouse transfers, and last-mile delivery.

- Heavy-duty, long-haul operations: These trucks cover 300km–600km per day, often carrying high payloads. BETs face range limitations here, so green hydrogen or battery-swapping models may be more viable. However, hydrogen infrastructure is still in pilot stages and needs rapid expansion. Recent studies suggest that zero-emission drivetrain technologies may be appropriate for such operations.

- Mining, construction, and industrial logistics: These involve high vehicle utilization in centralized zones. Hydrogen fuel cell electric vehicles (FCEVs) may offer advantages due to shorter refuelling times and higher range.

While electrification is gaining traction, alternative fuels such as bio-CNG, LNG, and renewable biofuels also offer promising pathways, especially for segments where battery or hydrogen solutions may face limitations. These fuels can complement electrification efforts and help accelerate the transition in areas with different infrastructure or operational constraints.

Further, scaling these technologies requires targeted charging and refuelling infrastructure. Unfortunately, most of India’s public charging stations are designed for cars, not commercial trucks. High-capacity chargers (megawatt-level) are rare, and hydrogen stations are still in the pilot stage. Success will depend on proving the economic and operational feasibility of these technologies and scaling them beyond pilots into mainstream adoption.

Financing the shift to clean freight

Even with ZET technology becoming more affordable, as seen in the case of falling electric battery prices, high capital costs remain the biggest barrier to ZET adoption. Though ZETs can reduce fuel expenditures by up to 46% over their lifetime, their high upfront cost (2.5 to 3.5 times higher than diesel trucks) remains a major barrier. This is especially true for India’s fragmented freight market, dominated by small and medium fleet operators with limited access to formal credit. Innovative financing solutions can help unlock adoption:

- Leasing and pay-per-use models: These reduce upfront costs for fleet operators and allow them to scale gradually.

- Blended finance: Combining public grants, concessional loans, and private investment to de-risk early-stage projects.

- Battery-as-a-Service (BaaS): Allows fleet operators to pay only for battery usage while third parties own and manage the battery assets.

- Carbon market instruments: Monetizing avoided emissions through carbon credits could offer new revenue streams to early adopters.

However, the sector faces a “chicken-and-egg” dilemma: low truck demand limits infrastructure investment, while poor infrastructure limits demand. Only a synchronized policy and investment push can break this cycle. Drawing lessons from the passenger EV market, where targeted fiscal incentives, subsidies, and private equity have catalysed uptake, will be critical.

Key challenges to scaling zero-emission trucking in India

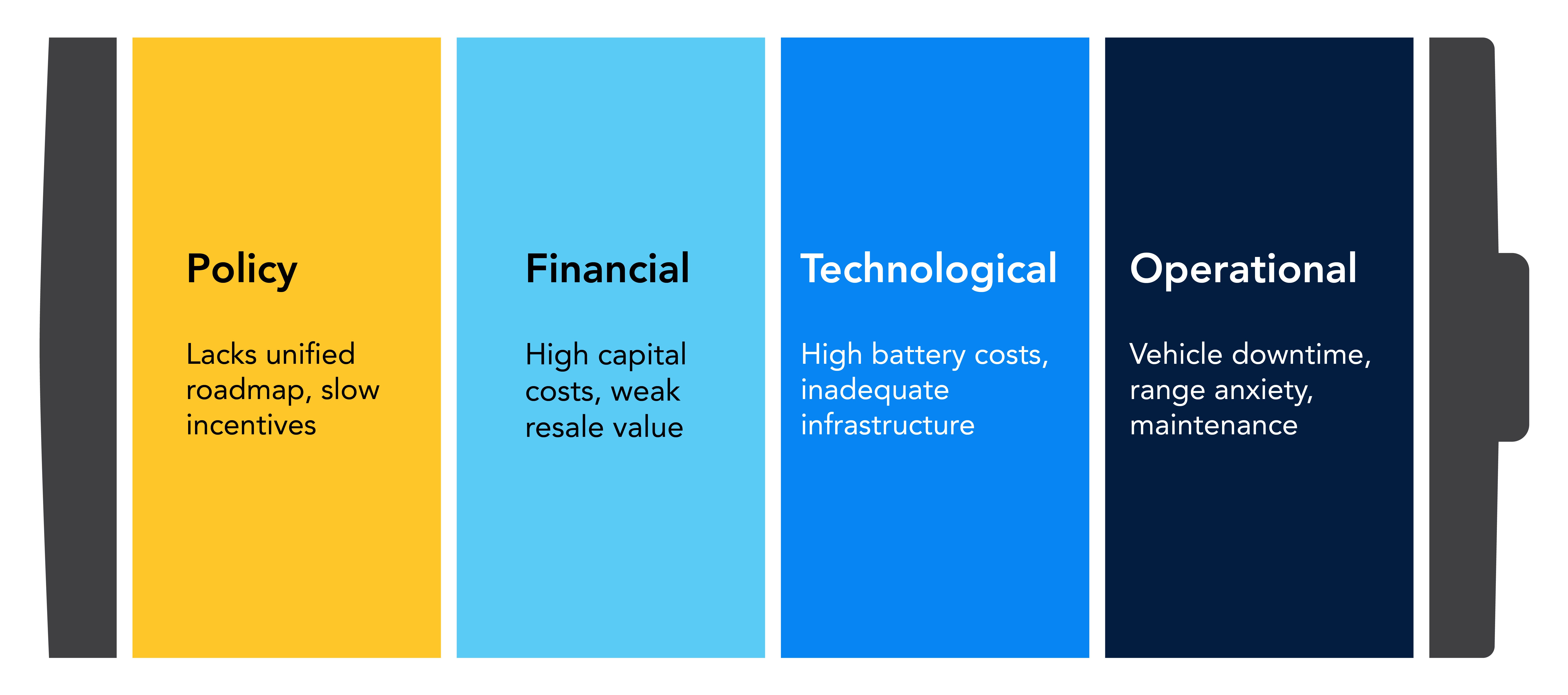

Despite clear benefits, ZET adoption remains limited. Less than 1,000 electric trucks (MDVs and HDVs) are currently registered nationwide. Major roadblocks are shown in Figure 2.

Figure 2: Challenges to scaling zero-emission trucking in India

Clean truck technologies are emerging, but the market is not yet ready.

Electric trucks are gaining traction, but technologies for heavy-duty freight are still maturing. Most charging infrastructure caters to passenger vehicles, leaving long-haul freight corridors underserved. Green hydrogen, though promising, faces storage and safety limitations due to the lack of standardized cryogenic and high-pressure systems in India.

High upfront costs and limited financing slow adoption.

ZETs cost significantly more than diesel trucks, making them unaffordable for many small fleet operators. Access to credit is limited, and resale markets are underdeveloped. Many operators are unfamiliar with lifetime cost savings, and key components like fuel cells and batteries are imported, adding to costs.

Operational challenges reduce fleet confidence.

Longer charging and refueling times can disrupt delivery schedules. Sparse infrastructure and limited battery range create range anxiety, especially for long-haul routes. Servicing centers and trained technicians for ZETs are scarce, and drivers often lack training in electric drivetrains and energy-efficient operations.

Policy momentum is building but needs deeper alignment.

India has launched several initiatives to support cleaner freight, including fuel efficiency standards and ZET corridors. However, a unified national roadmap with freight-specific incentives and coordinated implementation across ministries is essential to accelerate adoption and scale impact.

Global best practices: What India can learn from front-runners in freight decarbonization

Several global entities are advancing HDV decarbonization through stringent targets, financial incentives, and infrastructure support:

The European Union (EU) has established stricter CO₂ emission standards for trucks, aiming for a fleet-wide average reduction of 45% by 2030, 65% by 2035, and 90% by 2040, based on 2019 figures. The Alternative Fuel Infrastructure (AFIR) ensures sufficient publicly accessible electric recharging and hydrogen refuelling stations throughout the EU. For India, this highlights the importance of setting clear, long-term targets and backing them with robust infrastructure regulation planning.

Germany offers ZEV purchase grants for transport companies, providing up to €40,000 for ZETs, covering up to 80% of additional investment costs until 2023. The country is also implementing a CO₂-based road charging system, adding a surcharge to the existing toll system based on the vehicle's emissions class. Germany’s extensive funding program for charging and refuelling infrastructure shows how purchase subsidies and emissions-based tolling can help shift fleets toward cleaner technologies.

The road ahead: Turning vision into action

India stands at a pivotal moment. Decarbonizing the freight sector is not only a climate imperative—it’s also a socio-economic opportunity to create green jobs, strengthen energy resilience, and improve air quality.

But key questions remain: Are current incentives strong enough to de-risk early adoption? How can policy clarity accelerate OEM investment and fleet operator buy-in? And what kind of coordination is needed across central and state governments? To move from pilots to full-scale transformation, India must act on five priority fronts:

- Accelerate ZET deployment: Launch targeted incentives for electric trucks, expand PLI schemes to include ZET components, and mandate ZET procurement in public freight fleets.

- Build infrastructure at scale: Develop renewable-based charging hubs along freight corridors, enable land access and grid integration, and expand hydrogen pilots into commercial ecosystems.

- De-risk early investments: Encourage blended finance structures, foster leasing markets, and create demand aggregation platforms to support MSMEs and fleet operators.

- Strengthen institutional coordination: Establish a national freight decarbonization task force involving MoRTH, MNRE, MoP, and state governments to align incentives, policies, and funding.

- Enhance data and R&D capacity: Invest in indigenous technology development, build digital MRV systems for emissions and energy tracking, and foster public-private research partnerships.

With the right mix of technology, finance, infrastructure, and policy alignment, India can lead the way in clean freight transformation, ensuring that trucks, once symbols of pollution and congestion, become drivers of a more sustainable future.

The question isn’t whether India can drive clean freight, but how fast we can make it happen.