Unemployed Americans are struggling financially, yet they think it is too soon to reopen nonessential businesses.

Editor’s Note (06/24/2020): This article includes findings from our third wave of data collection that fielded May 18 through May 20. This third wave collected another 1,000 completes using a census-balanced, national non-probability sample. The new information, shared below, examines the economic challenges Americans are experiencing amidst growing unemployment during the COVID-19 pandemic. Learn more about the ICF COVID-19 Monitor Survey of U.S. Adults.

At the time of the survey, approximately 40 million Americans had filed unemployment insurance claims since the beginning of the pandemic, signaling the worst economic decline since the Great Depression. In the face of this economic collapse, many states across the country began phased reopenings of nonessential business with various restrictions. In this article, we analyze the impact of American unemployment on perceptions regarding the reopening of the country.

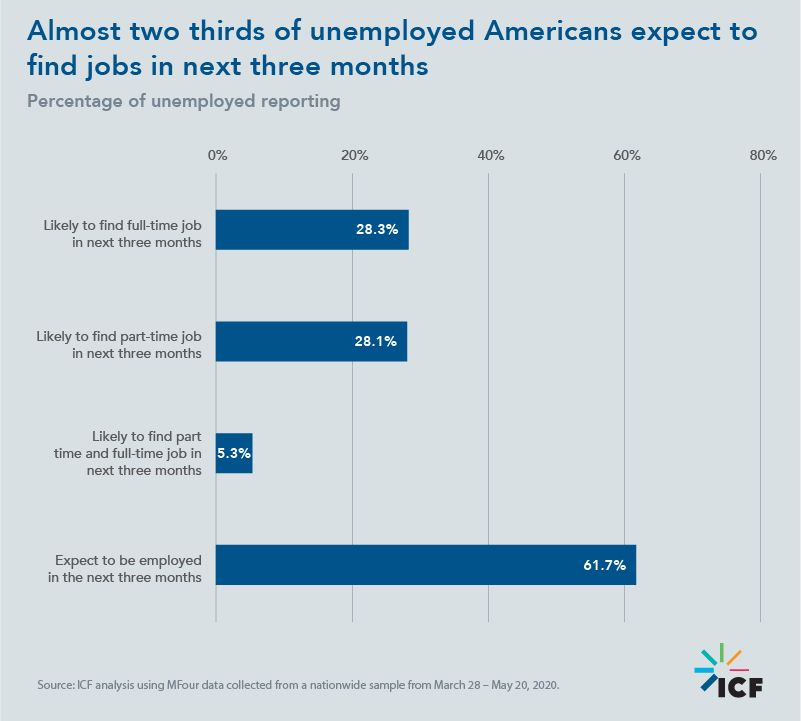

Most unemployed Americans report a reduction in income from a year ago, but almost two thirds of the unemployed anticipate finding jobs in the next three months.

In May, 15% of respondents indicated they were unemployed and looking for work, with 57% of those unemployed also reporting a reduction in income. Despite states looking to reopen businesses across the United States, only 62% of those currently unemployed expect to find a new full- or part-time job in the next three months. Almost a third (28%) of unemployed respondents thought it likely they would find a full-time position within the next three months. Similarly, 28% of unemployed respondents thought it likely they would find a part-time position within the next three months. Five percent expect to find both.

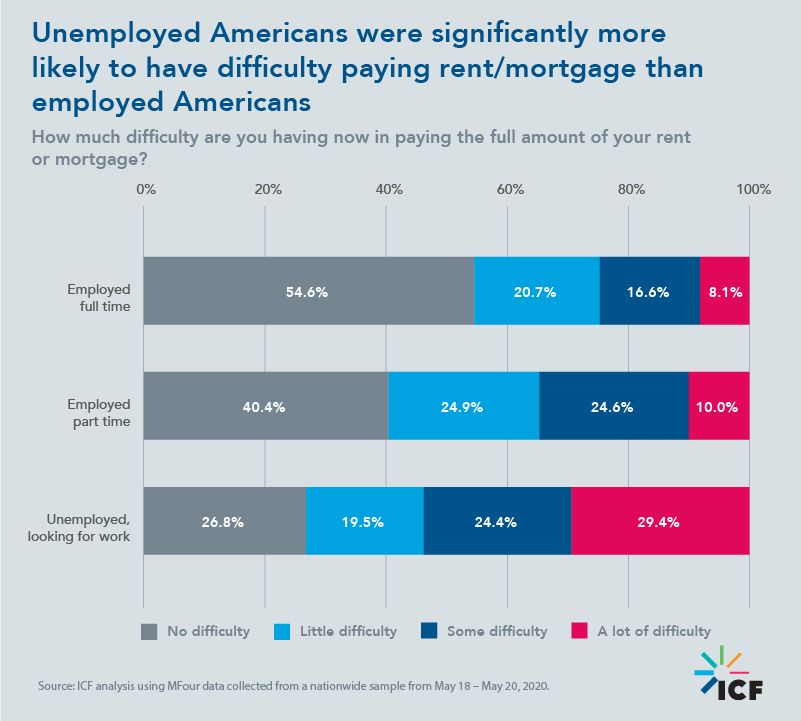

Majority of unemployed Americans report some or a lot of difficulty paying their rent or mortgage.

The financial impact of unemployment is considerable. As mentioned above, 57% of unemployed Americans who are looking for work reported a decrease in their current income compared to a year ago. Furthermore, Americans who reported being unemployed and looking for work in May were significantly more likely to report having difficulty paying their rent or mortgage compared to employed Americans. Although a quarter of those who are employed full time are having at least some trouble in paying their rent or mortgage, a majority (54%) of unemployed Americans reported some or a lot of difficulty paying their rent or mortgage.

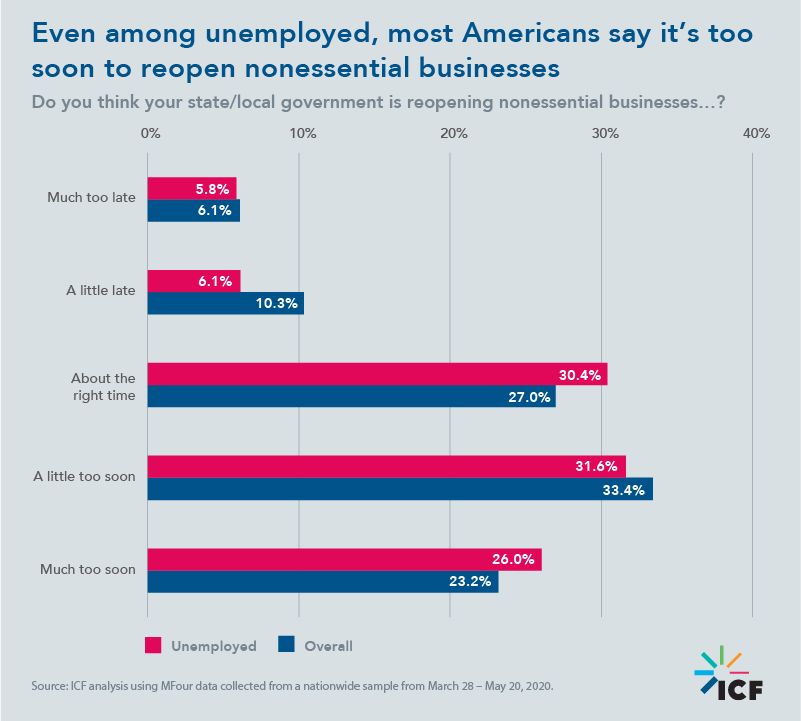

Most Americans, including the unemployed, still believe it is too soon to be reopening nonessential businesses.

For many states, May signaled the end of stay-at-home orders, and the beginning of phased efforts to reopen nonessential businesses. The majority of Americans (57%) felt that the reopening of nonessential businesses was occurring too soon, while 27% indicated it was occurring at about the right time, and 16% reported it was occurring too late. Among unemployed Americans, despite the considerable hardship, the sentiment is largely similar, with 58% reporting that reopenings of nonessential businesses were occurring too soon.

Watch this space

How will American views on reopening nonessential businesses evolve as the summer progresses? Will speculation about a potential autumn wave of COVID-19 stoke fears and cause the public to resist reopenings even more, or will prolonged economic distress cause public sentiment to swing in the other direction? We will continue to report key findings from our data collection efforts over the coming weeks and share this information with public health officials in support of their response to COVID-19. Sign up to receive alerts as we roll out upcoming results and package our insights into reports.