An agile approach to home mortgage data sharing

What’s the best way to publish and disseminate Home Mortgage Disclosure Act (HMDA) data, the most comprehensive publicly available information on nationwide mortgage marketing activities? Our team of technical experts answered this question during the Consumer Financial Protection Board’s HMDA Virtual Tech Sprint.

One of the purposes of the Home Mortgage Disclosure Act is to assist public sector officials in directing public investment or subsidies to stimulate private sector lending and investment in neighborhoods in need of credit and capital.

Preparing for the sprint

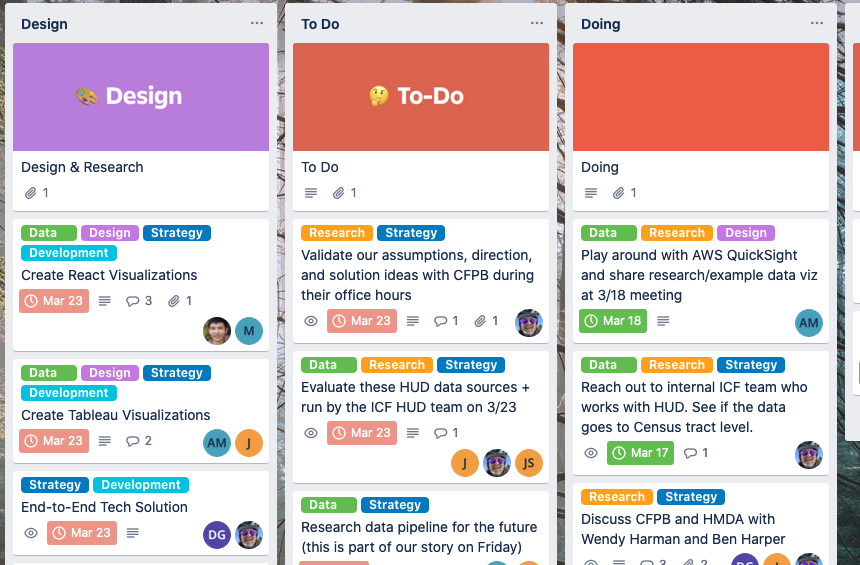

Our team included a product owner, visual designer, front-end developer, and two data engineers—plus a team lead. To prepare for the sprint, we learned about the environment from the Consumer Financial Protection Board (CFPB) and how to use some of their tools. We practiced agile methodology, including managing our work through Trello and collaborating through daily standups and working sessions.

We also considered other sources of housing data where we hold expertise, such as the Housing and Urban Development (HUD) programs that ICF supports through website development and technical assistance.

“We thought the combination of HMDA data with other federal data sets could provide a more comprehensive view of housing activity and neighborhood development in the U.S.,” explained Jeremy Vanderlan, our experience and product strategy expert.

Problem solving through collaboration

“Our problem statement was to create a tool that describes patterns of public sector investment and subsidies from two major HUD programs, HOME Investment Partnership and Community Development Block Grant (CDBG), at the census tract level,” project manager Dan Gorman said. “We then planned to compare this public sector funding to private sector lending activity on a census tract level as revealed via the Home Mortgage Disclosure Act data.”After we shared our problem statement with HMDA, the National Community Reinvestment Coalition (NCRC) reached out to us with a request to tackle the tech sprint challenge together. We worked with our new teammates to begin analyzing the data: HMDA data for the commonwealth of Virginia, HUD data from the HOME Investment Partnerships Program, and CDBG data. With the data in hand, we narrowed our focus to Richmond, Virginia.

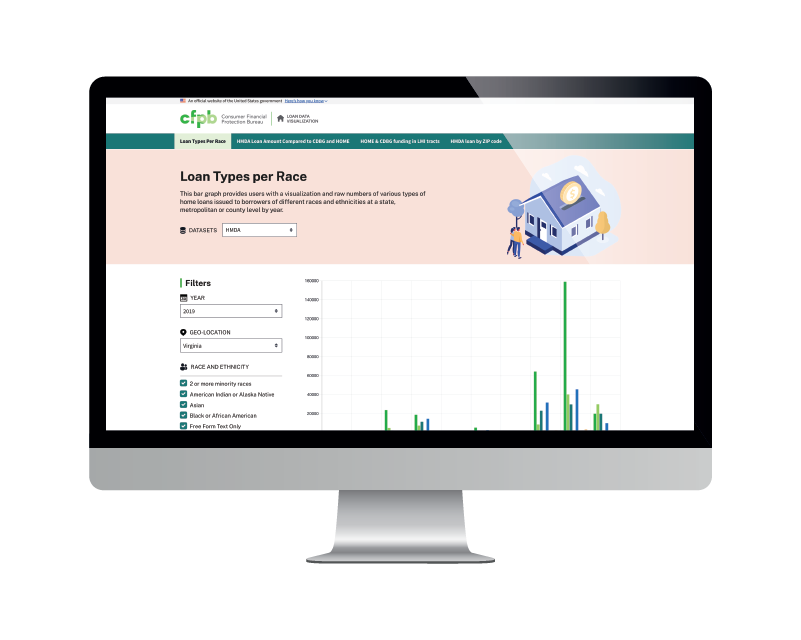

We developed four distinct use cases and data visualizations with a technology stack of Chart.js, React, Tableau, GitHub, and AWS.

- Loan types per race

- HMDA loan amount compared to CDBG and HOME funding per census tract

And two aspirational use cases:

- HOME and CDBG funding in low-and-moderate income tracts compared to HMDA lending

- HMDA single family loan dollars per capita by ZIP code

The first two visualizations began to tell the big picture story of our problem statement—taking the HMDA data and looking at the types of loans by race in the commonwealth of Virginia, then comparing that HMDA data with the HUD data to begin to establish comparisons between public and private investment patterns.

A case for broader applications

We developed an intriguing problem statement that has the potential for broad application across other cities and metro areas. We received positive feedback from the CFPB panel, noting that we had one of the most detailed and specific problem statements of the day and developed an intriguing hypothesis for the use of HMDA data with other federal data sets. The panelist from the Census Bureau raised the opportunity to use more census data to inform that analysis, merging the demographic data from the Census with the public and private investment data from CFPB and HUD.Sprints like these provide firms with the opportunity to demonstrate our capabilities, but also to discover new use cases and utility in the tools and data sets we maintain. We enjoyed the opportunity to participate and are proud of the possibilities and data use cases we shared with CFPB.