Forecasting the 2021-2022 PJM auction

What the future holds for the PJM Base Residual Auction.

Over the last few years, PJM has seen declining capacity prices in the Base Residual Auction (BRA), despite the introduction of capacity performance penalties. This has resulted in a negative outlook for future prices among many market participants. However, with the large number of distressed coal and nuclear units, along with several key market parameter changes, ICF sees potential for increased prices in the upcoming 2021-2022 auction. Several coal and nuclear units, including Pleasants, Perry, Beaver Valley, and Davis-Besse, have announced their plans to retire before 2021, which could have noticeable price impacts.

Additionally, several PJM regions have become more constrained compared to past auctions, which could also drive local price increases. In this post, we explore the prominent market dynamics that drive price volatility in PJM’s capacity market. We also highlight several regional changes from the past auction and discuss how some recent market shifts may affect bidding behavior.

Market Conditions

The PJM Base Residual Auction (BRA) for the 2021–2022 capacity period is taking place between May 10 and May 16, and the results are expected to be released on Wednesday, May 23.

Historically, changes in market rules have been an important driver for price volatility. For example, in the last three auctions, PJM introduced the new capacity performance product, and PJM RTO capacity prices varied between $77/MW/day and $165/MW/day. Capacity performance changed the rules of who can participate and introduced penalties for non-performance, which increases the cost of participation.

Other regulatory changes in the last three auctions include an increase in the offer caps, the elimination of short-term procurement targets, and several restrictions in the participation of demand resources (DR), including participation of price responsive demand in the last auction.

Unusually, there are no significant regulatory changes for the upcoming auction. However, in March 2017, PJM proposed additional restrictions on imports (ER17-1138), requiring all external resources to pass interregional coordination, electrical distance, and market-to-market flowgate tests. In November 2017, Federal Energy Regulatory Commission (FERC) accepted PJM’s filing to be effective in the upcoming auction.

ICF estimates that imports to PJM could decrease by approximately 1,000 MW from 4,000 MW in the last auction to approximately 3,000 MW. ICF estimates that this change will have a minimal effect, increasing PJM RTO prices in the range of $6–$9/MW/day. This is consistent with PJM Independent Market Monitor’s (IMM) estimates .

Changes in auction parameters have been another source of historical price volatility in the BRA. The auction parameters are released before the auction and are used to determine the demand curves that will be used in the auction. Auction parameters include peak demand/procurement requirements, net cost of new entry (CONE), and import constraints (CETL) and local capacity requirements (CETO) for the transmission constrained Local Deliverability Areas (LDAs). The table below provides the key parameter values for the upcoming auction and compares these with the parameter values from the previous auction:

Exhibit 1: 2021/2022 BRA Auction Parameters and Delta

| Reliability Requirements (MWs) | Net CONE ($/MW/Day) | CETL | CETO | |

| 2021/2022 BRA Parameters | ||||

| RTO | 166,355 | 322 | NA | NA |

|

MAAC |

NA | 293 | 4,019 | -8,870 |

| EMAAC | NA | 314 | 9,000 | 2,500 |

| PS | NA | 331 | 6,902 | 5,620 |

| ATSI | NA | 307 | 8,439 | 6,020 |

| COMED | NA | 344 | 5,574 | -640 |

| Delta 2021/2022 vs. 2020/2021 BRA | ||||

| RTO | 29 | NA | NA | |

| MAAC | NA | 40 | -199 | -1,870 |

| EMAAC | NA | 31 | 200 | -1,150 |

| PS | NA | 24 | -1,099 | -280 |

| ATSI | NA | 46 | -1,450 | 1,360 |

| COMED | NA | 15 | 1,510 | -1,280 |

Reliability requirements have decreased by 1,289 MW. This is expected to result in a minimal decrease in the RTO capacity prices in the range of $3–$5/MW/day.

Net CONE reflects the leveled cost of new entry (CONE) net of energy margins for a new peaking unit. Depending on the LDA, the net CONE for the upcoming auction has increased from $15/MW/day to $65/MW/day. For the RTO region, the net CONE increased by $29/MW/day. PJM is using historical market prices from the last three years to estimate energy margins for a proxy peaking unit. As the high energy prices and margins of the 2013–2014 period (polar vortex) are no longer used, the estimated proxy unit energy margins have decreased, resulting in higher net CONE values.

These elevated values, in turn, increase prices along the demand curve, resulting in higher capacity prices at every quantity. Additionally, PJM also increased the Energy Efficiency (EE) add back3 in this auction by approximately 1.5 GW, which also shifts the demand curve to the right and puts upward pressure on the capacity prices. ICF estimates that the combined impact of net CONE and EE add back

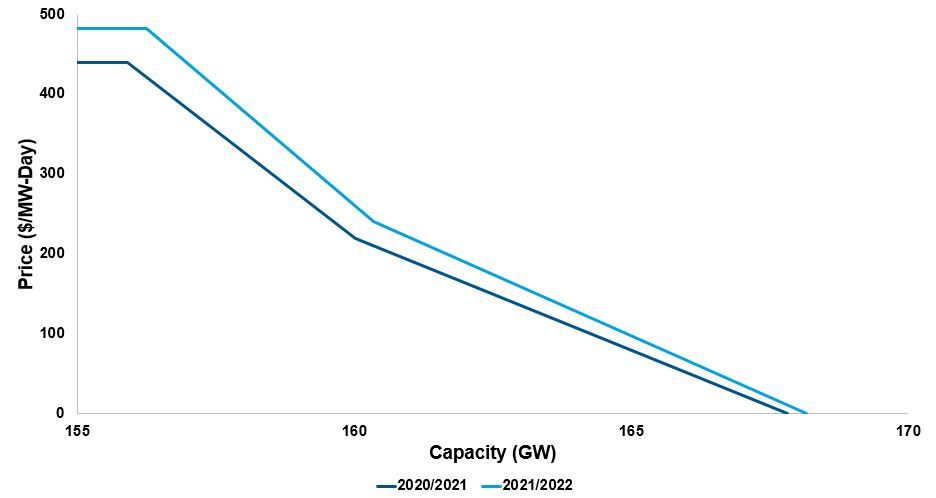

Exhibit 2 provides a comparison of 2020–2021 and 2021–2022 VRR curves after accounting for reliability, net CONE, and EE add-back changes and Price Responsive Demand.

Exhibit 2: 2020–2021 and 2021–2022 RTO VRR curves

Market participants underestimate the significance of Capacity Emergency Transfer Limits (CETL) on capacity prices for both the individual LDAs and their parent regions4. When the CETL is tight enough for an LDA to be constrained, high priced local capacity will clear to meet the LDA’s reliability requirements. Since the LDAs are nested within their parent regions, the high priced local capacity still contributes to the supply of the parent region despite not clearing at the parent region price and is placed at the bottom of the parent’s supply curve. Therefore, decreasing the CETL of an LDA could result in higher capacity prices for the LDA and lower capacity prices for the parent.

Several LDAs have had changes to their CETLs and reliability requirements that may affect prices:

- MAAC and EMAAC have had marginal changes in CETL (a 2% increase in EMAAC and a 4% decrease in MAAC) with decreases in reliability requirements.

- The PSEG CETL has decreased by 1,099 MW (14%) due to adjustments following the termination of the ConEd wheel agreement while the reliability requirement has decreased by 280 MW. These changes result in a much tighter capacity situation in PSEG. With the current resources and those projected to come online before 2021, ICF estimates that PSEG will have sufficient capacity to meet the local reliability requirements and will continue to clear at the EMAAC price. However, any retirement or significantly higher bidding in this region could potentially result in the region separating from EMAAC.

- Both the CETL and reliability requirement decreased for COMED, which ICF estimates will have a marginal impact on COMED prices and COMED will continue separating.

- The CETL for ATSI also decreased by 1,450 MW. This, combined with the announced FES retirements, significantly tightens the capacity supply situation in this LDA. As discussed below, rational bidding by coal generators in this LDA could potentially result in ATSI separating from the RTO.

In addition to the auction parameter changes discussed above, there are many supply changes that will also affect the upcoming auction. Pleasants and FES nuclear units have announced their plans to retire before the 2021–2022 capacity period and, as a result, will most likely not clear in the upcoming auction. ICF expects that there could be approximately 2 GW of new CC capacity and approximately 1 GW of new energy efficiency that could clear in this auction and partially offset the impact of the retirements.

Another major driver of capacity prices in the auction is the participant’s bidding behavior that defines the supply curve of the auction. Theoretically, a bid in the BRA should reflect the net going-forward cost of the associated resource. However, the market monitor reports that 112 resources, or about 10% of all resources offered, bid zero in the auction. Even positive bids are often discounted significantly below net going-forward costs, as bidders want to improve their chances to clear the auction in anticipation of improved future margins.

While there is an expectation that rational bidding behavior will prevail in the future, several events and recent market developments could justify underbidding in the upcoming auction. These include:

- During the 2017–2018 cold snap, several generators, especially in PJM East, realized improved margins.

- PJM’s Energy Price Formation proposal, if implemented, is expected to increase power prices and improve economics of all generators.

- PJM’s proposal to value fuel security, depending on how it’s implemented, could improve the economics of the stressed coal and nuclear units.

One could expect that changes in the bidding behavior, which could result in significant retirement and recovery in BRA prices, are low probability factors in the upcoming auction. One should focus on the bidding behavior of some specific market participants:

- Since the last auction, Exelon has started receiving subsidies for its Quad Cities nuclear facility in COMED. This facility did not clear the auction year. Regardless of how Exelon accounts for these subsidies, ICF expects that capacity prices in COMED and RTO will not be materially different, and COMED will still clear at a higher price than RTO.

- Nuclear legislation approved by New Jersey will allow the 2,296-MW Salem nuclear plant, co-owned by PSEG and Exelon Generation, and PSEG’s fully owned 1,172-MW Hope Creek nuclear plant to receive zero-emissions credit payments. ICF’s analysis indicates that these resources were marginal in the last auction, and regardless of how PSEG accounts for the subsidies, ICF does not expect changes in the capacity prices of EMAAC and/or RTO, all else being equal.

- The ongoing bankruptcy and restructuring of FES and the resulting impacts on the participation of its resources in the auction are some of the major drivers of uncertainty. On March 28, 2018, FES filed deactivation requests for its three nuclear facilities: the 900-MW Davis-Besse facility in ATSI, the 1,250-MW facility also in ATSI, and the 1,810-MW Beaver Valley facility in DUQ. While FES needs to offer these units in the auction, ICF believes that high offer prices will prevent these facilities from clearing the auction. Additionally, ICF believes that the ATSI coal facilities will be bid on in the auction at rational prices. The magnitude of these bids compared to the coal in the rest of RTO and the relatively tight supply-demand balance in ATSI could potentially result in regional price separation.

Conclusion

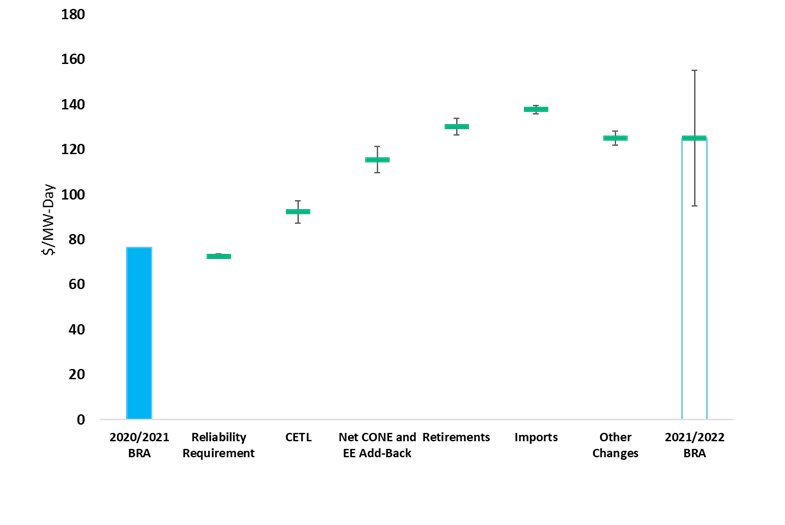

Accounting for all the changes discussed above, ICF estimates that the PJM RTO capacity prices will increase in the 2021-2022 Base Residual Auction. ICF’s expected price range is around $95/MW/day to $155/MW/day, with an expected price around $125/MW/day. ICF expects continued separation for EMAAC and COMED. There is also potential for ATSI, PSEG, and DEOK separation depending upon bidding strategies of units in these locations. In the scenario where all the above LDAs separate, the RTO prices will most likely be in the lower range of ICF’s expectations. The exhibit below provides an estimated impact of key drivers on the RTO capacity prices.

Exhibit 3: 2021/2022 PJM RTO BRA Price Expectation and Waterfall Chart

- 1PJM does not disclose the supply curve. ICF simulates the supply curve using the auction results and results of the IMM sensitivities.

- 2Analysis of the 2020/2021 RPM Base Residual Auction, page 72; a 25% decrease on imports (~1000 MW) results in a $9/MW/day increase in PJM RTO capacity prices.

- 3 PJM includes the impact of energy efficiency resources in their load forecasts. Since energy efficiency resources are also allowed to participate as capacity resources, PJM incorporates an EE add-back mechanism to avoid double counting.

- 4More discussion of LDA price dynamics and their correlation with the parent region can be found in ICF’s auction paper from last year (https://www.icf.com/resources/white-papers/2017/insights-from-pjms-2020-2021-capacity-auction)