Energy system transformation

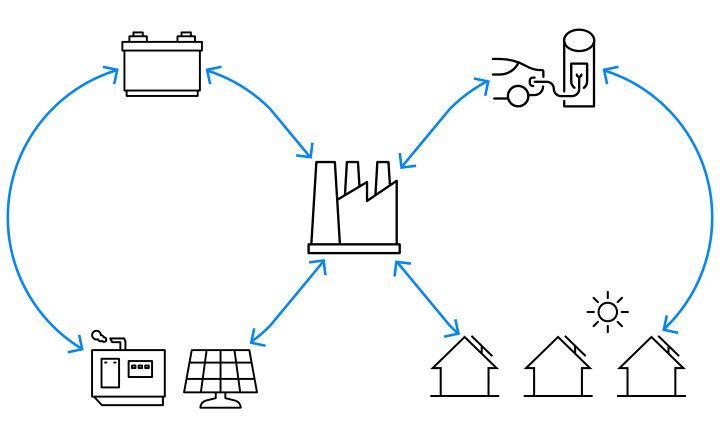

Integrate customer-sited assets into planning and programs

Customers have more energy management options than ever. How do utilities design programs that support customer demands for distributed energy resources—while boosting grid reliability, and ensuring reasonable costs? Using our proprietary analytics platform, we help utilities treat their customers as grid partners and design programs that meet their needs and lifestyles.

Manage resource and grid inter-dependencies

Realizing the full benefits of distributed energy resources on the grid requires visibility and certainty around DER deployment and performance. We help utilities visualize how behind-the-meter DERs affect their grid load and implement management strategies to harness those resources. We also develop strategies to use DERs to reduce or offset wholesale procurement obligations, such as resource adequacy.

Modernize the grid

Where should you invest for a more resilient grid, and what does your technology roadmap contain? How do you replace aging infrastructure while building capabilities to integrate increasing deployment of DERs? We advise utilities on no-regrets investment strategies—identifying the processes, technologies, and control platforms that will help you address evolving grid and customer needs.

Our services

Utility strategy and planning

- Flexible demand management

- Regulatory support

- Gas and power markets

- Customer and grid analytics

- DSM/DER pilots and programs

- Asset valuation and independent engineering

- Technology roadmap

- Grid modernization and business strategy

- Customer experience design and delivery

- Resilience

Technologies

- Energy efficiency

- Demand response

- Distributed energy resources

- Renewable natural gas

- Hydrogen

- Electrification

- Behind the meter (BTM) storage

- Virtual power plants (VPPs)

- Microgrids

Analytics

- AMI data disaggregation

- Building energy modeling

- Probable and target program participation

- Achievable load reduction by measure