New coal plant retirements could spur record ERCOT scarcity conditions

It’s been a fiery week for ERCOT.

Over the last few months, many in the industry have been posing the same question: when will the scarcity pricing drought come to a close?

A series of recent retirements may have finally answered that question.

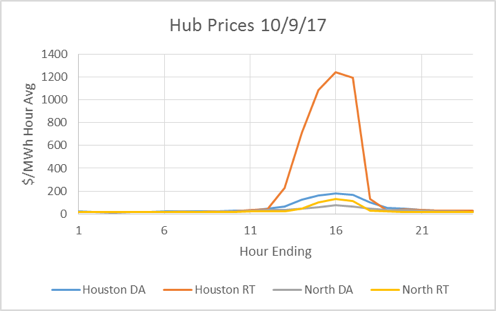

As industry giant Luminant announced the retirement of the Monticello coal plant at 1,865 MW, we analyzed the impact and predicted that the tide could be turning. As it turns out, that was just the beginning. That same week, Houston real-time prices spiked for over three hours, hitting a peak hourly average of $1,245/MWh between 3 and 4pm. Just days later, Luminant announced two more retirements: Big Brown at 1,208 MW, and Sandow units 4 and 5 at 600 MW each. Further, ERCOT’s quick review of retirements (90 days for these plants, extending to 150 days soon) and lack of forward capacity market mean immediate impact.

Make no mistake: the retirements announced last week change the entire dynamic of the market overnight, and create the possibility of the highest scarcity conditions ever seen in ERCOT for 2018 and 2019. ICF considered 2017 a market bottom, but such a drastic turnaround is beyond most observers’ expectations. Assuming the retirements proceed, we enter a below-equilibrium reserve situation with possibility of large scarcity pricing in 2018 – should weather, wind or outages exceed expectations during peak hours. The financial outlook for existing units improves dramatically as a result.

A Closer Look: Monday’s Price Spike

What happened? The price spike was mostly contained to the Houston area, though the South Hub area of ERCOT also topped out just over $500/MWh for one hour. The day-ahead market missed the spike, topping only $100/MWh. There appear to be two main causes: first, peak temperatures hitting 93 F at Houston Bush Airport—the second highest October temperature in the past 10 years (10/13/15 was the hottest, but no price spike occurred). Second, over 16 GW of total units were on outage during mid-day, compared to just 12-14 GW during mid-day a few days before and since.

What’s the takeaway? Importantly, this was not a manifestation of “scarcity” as we often refer to in the Operating Reserve Demand Curve (ORDC) price adder, as this is uniformly applied to all system wide prices. It appears, instead, to be a manifestation of continuing congestion and separation of the Houston area compared to the rest of ERCOT. In real-time, Houston has spiked above $1,000/MWh on six days so far this year. Next year, the Houston Import Project will add approximately 2 GW of capability into the region, potentially easing the spikes.

The Impact of Retiring Big Brown and Sandow

2018’s 12.2% Planning Reserve Margin would be the lowest prompt year planning reserve level any region has had in recent decades. It would also be a real test of ERCOT’s unique approach to scarcity and capacity expansion. At 12.2% reserve, very large increases in scarcity pricing is expected

What are the impacts? If no buyers materialize for Big Brown, and ERCOT doesn't award a reliability contract by February, ERCOT will be 4,273 MW shorter than anticipated—equivalent to 5.2% of net peak demand, moving reserve margins from what had been a projected 18.3% (in ICF’s view of firm builds and demand) to just 12.2%. With just the Monticello retirement, we projected an expectation of $1.8/MWh increase in all-hours prices due to ORDC scarcity.

One important caveat, though: the additional two plant retirements move the market into a realm where scarcity expectations become highly nonlinear. With Monticello, the expectation reserve margin of 15.6% is still above market equilibrium. However, 12.2% is below the expectation of market equilibrium. ICF is still analyzing the potential impact, but if that reserve margin holds (i.e. build pattern is as expected), there is real potential for levels of scarcity not seen since 2011. In addition to increase in scarcity, energy bids in the market may see upside from the loss of approximately 4,273 MW base load capacity.

To put the 4.3 GW figure in perspective, had that capacity not been there during 2016, for example, operating reserves (including load providing RRS) would have dropped to about 1.3 GW, triggering emergency pricing and forcing ERCOT to deploy all of its remaining load resources (such as ERS) to remain just above the minimum operating reserve requirement. Instead, what actually happened was a humdrum summer with no major price spikes. The plants further represent 22.1 TWh of generation in 2016, or 6.3% of total generation. Combined with its potential effect on the energy pricing, the total retirement impact could be worth billions to the market in 2018.

What happened? One week after announcing Monticello would close, Luminant more than doubled the scope of its retirements by adding another 2,300 MW in Big Brown and Sandow, though it said it would seek a potential last-minute buyer for Big Brown if there are takers. Vistra has filed a 120-day suspension notice for Big Brown than the 90-day notice requirement to complete a sales process and giving additional time to ERCOT for reliability analysis,

Who are Big Brown and Sandow? At 46 years old—the oldest in ERCOT—Big Brown is similar in age and situation to Monticello, and among the most likely candidates for incremental retirement. In addition to low power prices, it has been hurt by its depleting lignite mines and increased use of PRB by rail—over 2011-2014, it burned 55% lignite on average, but in 2016 and 2017 it has burned approximately 70% PRB.

Sandow includes two units: Unit 4 had private offtake and local fuel supply with Alcoa. The agreement was terminated with a one-time payment of $237.5 million to Luminant, and without the private offtake, Luminant reported that plant economics did not justify market exposure. Unit 5 is a more complicated case—unlike Big Brown, Unit 5 is among the newest plants in ERCOT, having come online in 2010. It utilizes circulating fluidized bed (CFB) technology, which reduces emissions but at higher variable operating costs. Nevertheless, Sandow 5 ran at a healthy 82% capacity factor in 2016 according to SNL.