Prolonged turbulence: What can the aviation industry do amid COVID-19?

The aviation industry is facing a serious challenge, but recent history shows evidence of resilience to sharp shocks.

COVID-19 is unprecedented and worldwide: individuals, organizations, governments, and businesses are having to adjust rapidly to the ongoing challenges of the pandemic. As well as health implications, the threat brings severe disruption to all walks of life and particularly to our social interaction and ability to travel. As a result, the global aviation industry has been dealt a particularly difficult blow. Over recent years commercial aviation has navigated a course through sudden shocks and crises, despite economic hardship. Can these experiences inform how the industry might cope, recover, and regroup in the face of this current pandemic?

An essential service

With commercial airlines at the heart of economic growth and a vital social link, most of us would argue that aviation is an essential service. During this pandemic, the International Air Transport Association (IATA) has made a case for the important role of crew and planes to transport vital medicine and medical supplies. Associated with this requirement is the need for air cargo to maintain capacity and supply chains for specialist equipment and other necessary goods.

The importance, speed, and popularity of flying is demonstrated in the customary numbers carried every day: some 10 million passengers fly to destinations around the world and goods transported are worth about $18 billion USD. The aviation industry has an important role to play in the global economy, representing 3.5% of the world’s gross domestic product (GDP) estimated at $2.7 trillion USD and supporting about 65 million jobs, including those with specialist skills and knowledge. So the implications of grounding millions of flights a day to stop the spread of COVID-19 are bound to be very widespread.

The impact of travel restrictions and closing borders

Governments around the world have had to respond to the spread of COVID-19 by closing borders and restricting travel. With little time for contingency plans, airlines are being forced to ground planes and cancel international flights--so they are already struggling to cope. In Europe, Ryanair, has said it will cut capacity by 80%, Air France by between 70 and 90%, Norwegian, BA, and Virgin along similar lines, while Austrian Airlines intends to stop all its regular flight operations. The picture has been changing daily and international big players, such as IAG, have been restricting flights to virus-dominated areas such as China, South Korea, and Italy. IAG’s chief executive, Willie Walsh, said that the group is “making significant reductions to our flying schedules. We will continue to monitor demand levels and we have the flexibility to make further cuts if necessary.”

Others around the world are also struggling with operations issues. Sweden’s SAS has retrenched staff and American Airlines and Qantas Group has suspended all international operations and stood down two thirds of its staff. Delta Air Lines has reduced system-wide capacity by 70% and is introducing stricter cost savings. Each day brings new developments. VIATA has already given a financial forecast for airline losses as a result of the pandemic and the falling passenger demand. According to the Guardian, IATA foresees a global revenue loss of $29.3 billion USD (£23.7 billion). It links $27.8 billion USD of that loss with Asia Pacific region of airlines, while the domestic China market alone would account for $12.8 billion USD of losses. Airlines outside the Asia Pacific region are predicted to bear $1.5 billion USD of the total loss of revenue. Globally, the demand for air travel is expected to decrease by 4.7% during 2020, which is the first overall global decline since the global financial crisis in 2008-9.

How aviation has coped with previous shocks and challenges

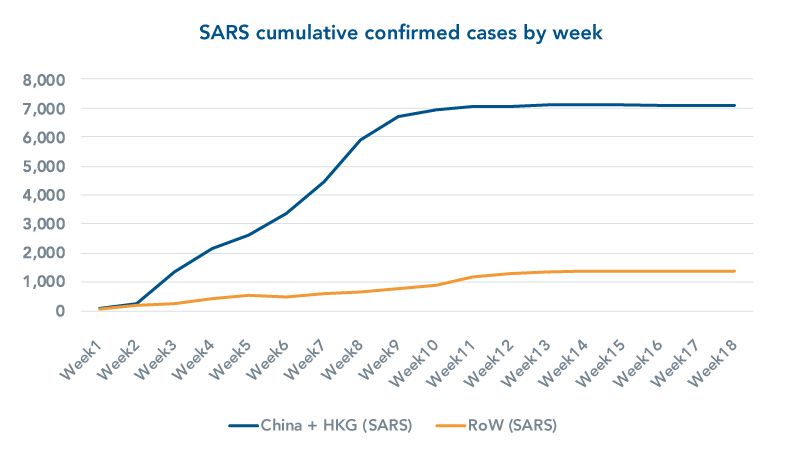

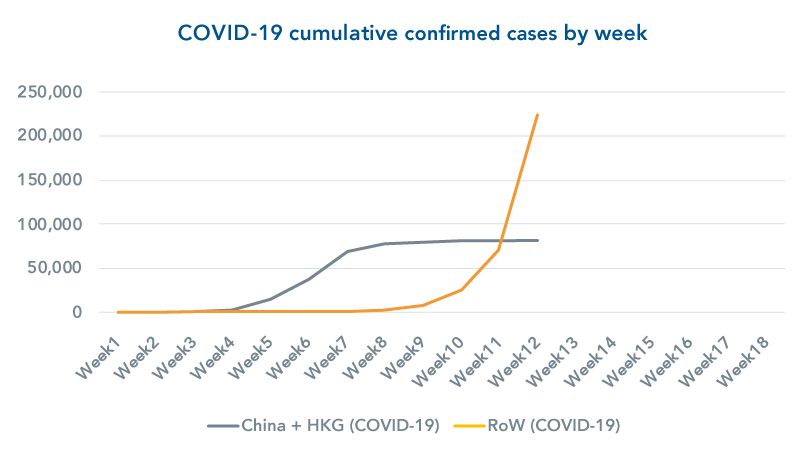

While the current situation is far from ‘business as usual,’ we can draw reassurance and insight from recent history which attests to how commercial aviation has weathered comparable trials and shocks, returning to growth and profit. The most obvious, and recent, comparable event was the outbreak and spread of Severe Acute Respiratory Syndrome (SARS) in 2002-03. Like the current pandemic, SARS was also a form of coronavirus and a highly contagious respiratory illness. The SARS crisis lasted about 10 weeks before the epidemic was brought under control. In the current COVID-19 epidemic, cumulative infections in China appear to have plateaued after about 7-8 weeks, broadly mirroring the SARS epidemic profile (blue lines in the charts below).

But the two pandemics differ in a significant way: whereas in the case of SARS, outbreaks outside of China and Hong Kong were limited to under 1,500 cases, COVID-19 has become genuinely global with cases outside of China far exceeding those within.

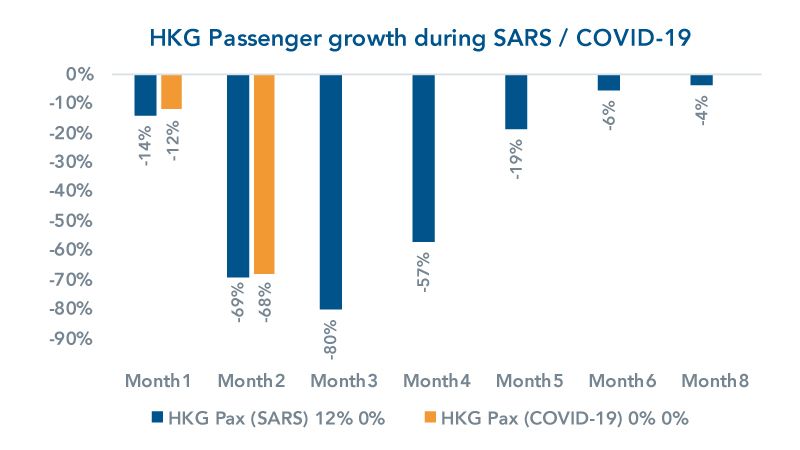

Nevertheless, analysis of Hong Kong International airport reveals some interesting similarities. During the SARS pandemic, the airport experienced a staggering decrease in passenger volumes (between 70-80%) during the period of rapid increase in infections. By June, (Month 4), when the rate of new infections greatly reduced, traffic was still impacted significantly – perhaps due to a combination of lingering caution as well as the impact of infections elsewhere in the world. In the current pandemic, the airport registered a 12% decline in January 2020 (Month 1) and a 68% decline in February (Month 2), closely mirroring the SARS profile.

Unlike in SARS, however, the impact has not been limited to China and Hong Kong. The second chart shows the daily variation (versus the same day the year before) of air traffic movements in Europe, demonstrating similar levels of impact in Europe as seen in Hong Kong (60-70% declines). These are just two examples; a similar pattern is being played out across much of the world, indicative of a crisis which is likely to be as severe as it is global.

Despite the unprecedented scale and breadth of this shock, we can still learn from previous shock events in the aviation industry.

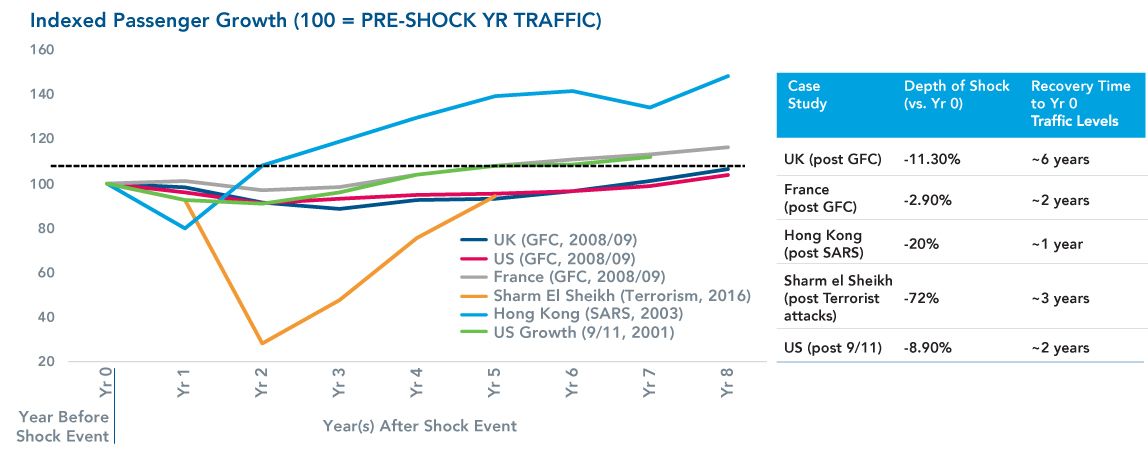

The 9/11 terrorist attacks had a striking impact on aviation, particularly in the U.S. They compounded the existing financial troubles that the airlines were experiencing beforehand, and resulted in a slew of airline bankruptcies. The federal government provided loan guarantees to the value of $10 billion USD and half that amount in short-term assistance. Despite this devastating blow, air traffic recovered just two years after the attack, rebounding to levels experienced at the start of the decade.

The global financial crisis, and the consequent global recession, resulted in a sustained weak performance in the UK aviation market. It took a good six years to reach pre-recession levels (one year after the economy reached its pre-recession level). In France, where the country was less exposed to the hard-hit financial sector, the recovery took just two years.

Sustained civil unrest and a number of high-profile terrorist attacks in Egypt caused traffic to fall by over 70% in Sharm el Sheikh. Just three years after the nadir, the airport had recovered to pre-shock levels.

All the above events had fundamental, albeit brief, impacts on demand for air travel, either through economic impacts (such as the GFC ), a fear of flying (9/11), or shift to safer destinations (Egypt terrorist attack). SARS, on the other hand, was unrelated to flying and did not have a lasting economic impact. The result was an extremely quick recovery to growth.

What could a recovery look like?

COVID-19 is still running its course. It is already demonstrating a very marked impact on air travel in 2020. It seems likely now that this could continue for some time. Domestic traffic is likely to recover first as individual countries contain their epidemics. International traffic will take longer and will likely be phased as countries open borders gradually and only to other countries that have contained the disease. The duration of the recovery will depend largely on whether there is a lasting economic impact, and whether airlines will be in a position to facilitate the growth required to recover. On the latter point, governments appear to be willing to provide the support required to keep (at least the major) airlines solvent during this crisis. Before the pandemic, aviation was set to maintain a strong increase in passenger demand. Once COVID-19 has receded, this growth is highly likely to return and we very much trust that it will.