Business aviation's remarkable rebound provides valuable lessons for airlines and airports

ICF explains the lessons airlines and airports can learn from business aviation’s resiliency during the ongoing COVID-19 pandemic.

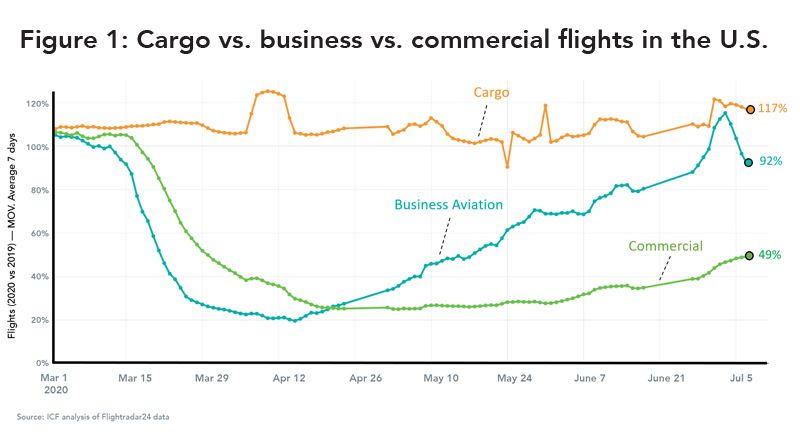

Throughout the COVID-19 pandemic, the only aviation segment in the United States to prove resilient has been air cargo. In the early days of the pandemic, when most of the population was under stay-at-home orders, business aviation and commercial passenger flights fell precipitously, the latter proving more resilient only thanks to U.S. government subsidies mandating a minimum level of activity (see Figure 1).

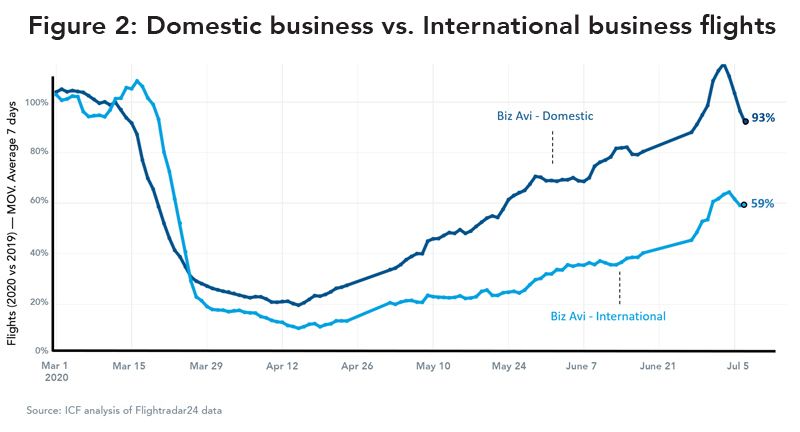

Business aviation activity has staged a remarkable comeback over the last few weeks, as states have progressively lifted their stay-at-home orders and commercial establishments have opened across much of the country. After hitting bottom in mid-April, business aviation flights have risen steadily, with domestic flights exceeding pre-COVID-19 levels in late June, while international flights are already at 50% of prior year levels (see Figure 2). It is important to note, however, that activity levels have receded in the first week of July, as rising COVID-19 cases have forced many states to roll back their reopening. This confirms just how vital it is to control the pandemic if aviation is to achieve a sustainable recovery.

How can we explain business aviation’s strong performance?

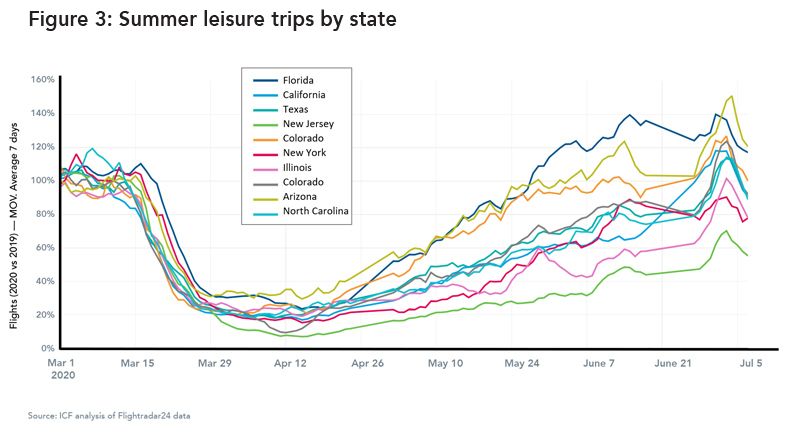

We know that corporate activity is not driving this resurgence, as most large U.S. companies maintain business travel restrictions. This is corroborated by a recent ICF survey of corporate travel departments indicating that over 90% of U.S. corporations have not resumed business travel as of yet. However, business aviation customers generally also fly private for personal reasons. We suspect this increase in activity is driven by high-net-worth individuals traveling with their families on summer leisure trips. This would explain why popular holiday states like Florida, California, and Colorado are driving the recovery, while states like Illinois and New York are lagging. Anecdotal evidence suggests that business aviation operators are also discounting heavily to incentivize travel, taking advantage of very low fuel prices.

While we cannot tell whether this resurgence will be sustained after the summer—particularly if social distancing requirements prevent businesses from holding in-person meetings in the fall—it does provide an encouraging sign. It also validates the redoubled efforts that airlines and airports are taking to address hygiene and passenger health.

People’s thirst for travel is alive and well. The fear of proximity to others, however, must be assuaged if we want to get people flying again.