As states relaxed restrictions in May, how did Americans feel about the threat of COVID-19 to their health?

Editor’s Note (6/9/2020): This article includes findings from our third wave of data collection that fielded May 18 through May 20. This third wave collected another 1,000 completes using a census-balanced, national non-probability sample. The new information, shared below, examines American attitudes about their personal health and COVID-19. Learn more about the ICF COVID-19 Monitor Survey of U.S. Adults.

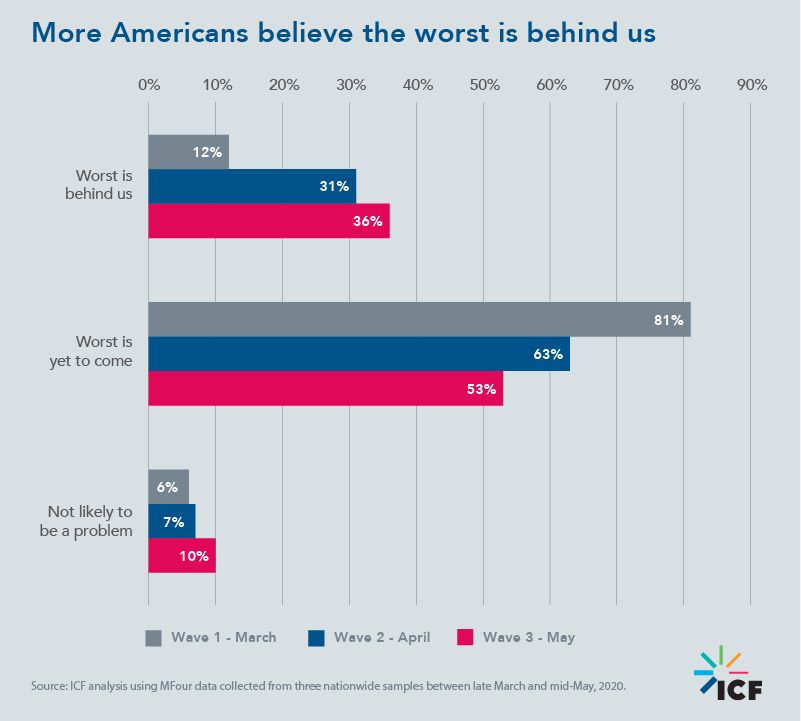

In March and April, Americans were still concerned about the threat that COVID-19 poses to public health, but an increasing percentage in April felt that the worst is behind us. Would this optimistic trend, captured in our April public health findings, continue in May, as more non-essential businesses reopened and some people began to relax their social distancing behaviors? This article takes a fresh look at public perception, more than two months after the start of the crisis.

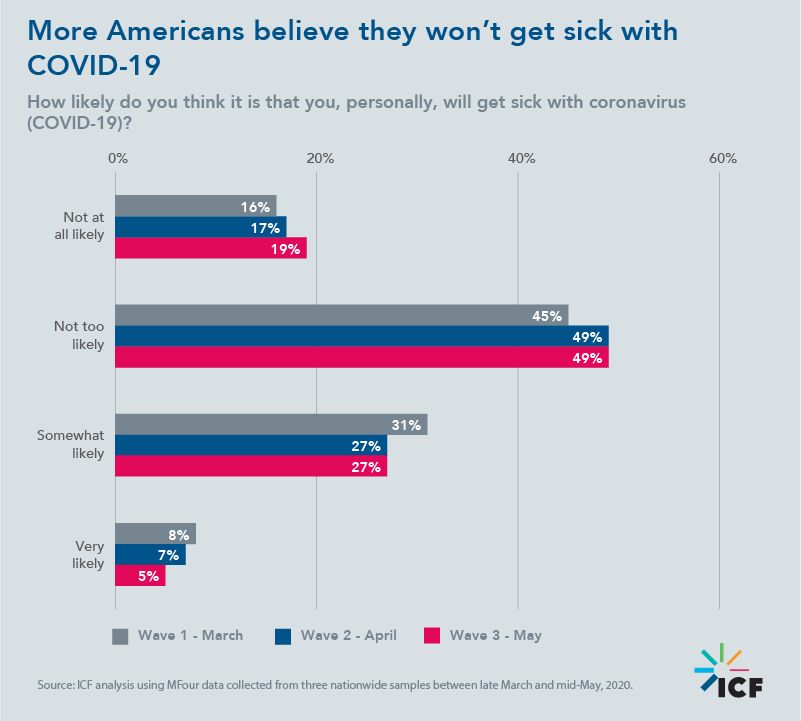

Americans increasingly believe they are unlikely to get sick with COVID-19.

Our third wave of data collection launched on May 18, 2020. At that time there had been more than 1.5 million positive tests results for COVID-19 in the United States and more than 90,000 deaths. States across the country were in various stages of reopening, with many placing restrictions on store capacity and/or store services (e.g., retail stores allowed to offer curbside service only). But does the relaxing of stay-at-home orders and the progression towards reopening mean that individuals feel that they are now less likely to get sick with COVID-19? The May data show that the number of Americans who report they are likely to get sick with COVID-19 has decreased slightly from month to month—from 39% in March to 34% in April to 32% in May).

In addition, despite recent reports of COVID-19’s disproportionately negative impact on minority populations, our data found no significant difference across race. In May, black adults felt they were no more likely (32%) than others (32%) to contract COVID-19. However, Hispanic, Latino, or Spanish-origin adults did believe they were more likely (43%) than non-Hispanics (30%) to contract COVID-19.

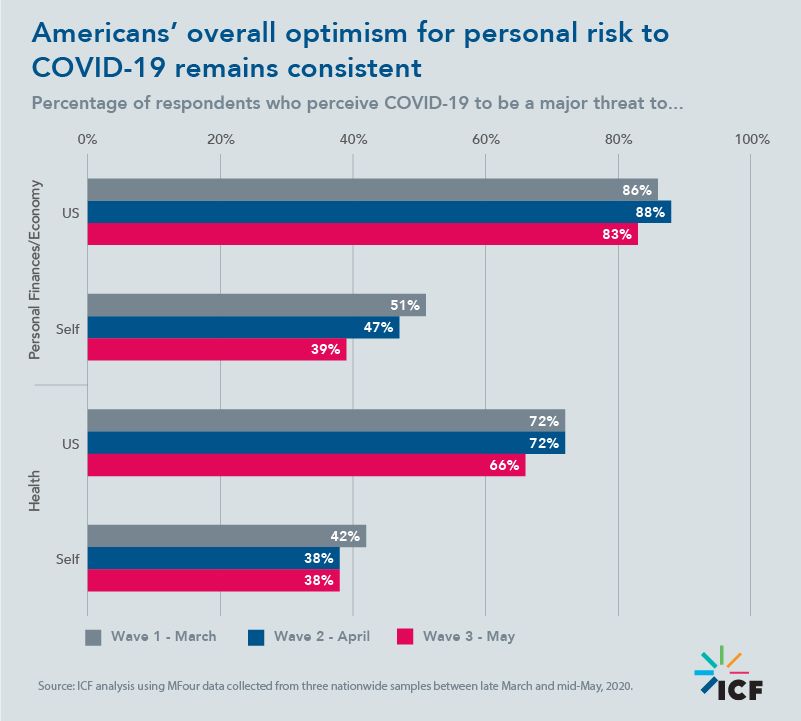

This overall optimism regarding personal risk to COVID-19 has been consistent across the survey. For all waves, respondents have rated the virus as more of a threat to the country—U.S. economy and health of U.S. population—than a threat to their personal health or personal financial situation. The proportion who consider the coronavirus outbreak a major threat to their personal financial situation fell from 51% in March, to 47% in April, to 39% in May. The proportion who consider the coronavirus a major threat to their personal health has also declined slightly since March, but the difference is not large enough to be statistically significant.

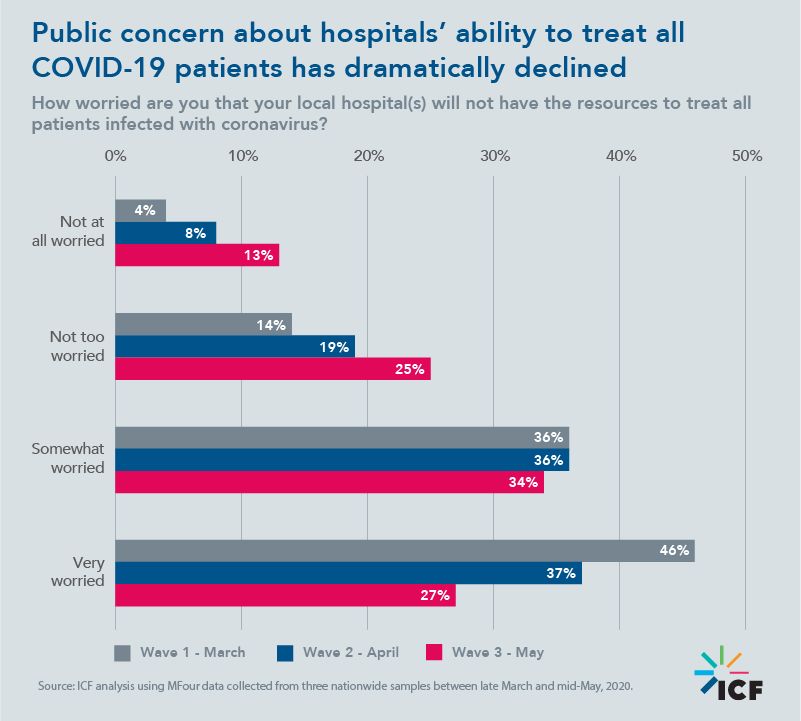

Americans are becoming less concerned about hospital resources

One of the primary concerns in the coronavirus pandemic has been whether hospitals and the health care system would have the resources to keep up with the number of COVID-19 cases. Consequently, one of the primary goals of the mitigation efforts has been to “flatten the curve” of new coronavirus cases to lower the peak of new cases and spread them over time. This would not necessarily reduce the cumulative number of total diagnosed cases of COVID-19, but would reduce the number of new cases at the peak so that they could be managed by the health care system.

Our three waves of data collection have documented a dramatic decline in public concern about the ability of local hospitals to treat all patients infected with the novel coronavirus. In late March, nearly half of the adults in our survey (46%) were very worried about their local hospitals having the necessary resources to treat all patients with the coronavirus. This percentage fell to 37% by mid-April. In our current survey, the proportion who were very worried about hospitals’ ability to treat all patients with COVID-19 fell further to 27%.

Similarly, while the majority of Americans still report that the worst is yet to come (53%), there has been a significant increase in the percentage of Americans who believe the worst is behind us—tripling from 12% to 36% since March.

Watch this space

How will public perception of the health risks associated with COVID-19 change as we transition into summer weather and activities? Will somewhat relaxed social distancing measures cause Americans to feel more or less anxious as the weeks pass? What effect will the widespread protests that are happening throughout the country have on public health? We will report key findings from our data collection efforts over the coming weeks and share this information with agencies and public health officials in support of their response to COVID-19. Sign up to receive alerts as we roll out upcoming results and package our insights into reports.