Where has all the load gone?

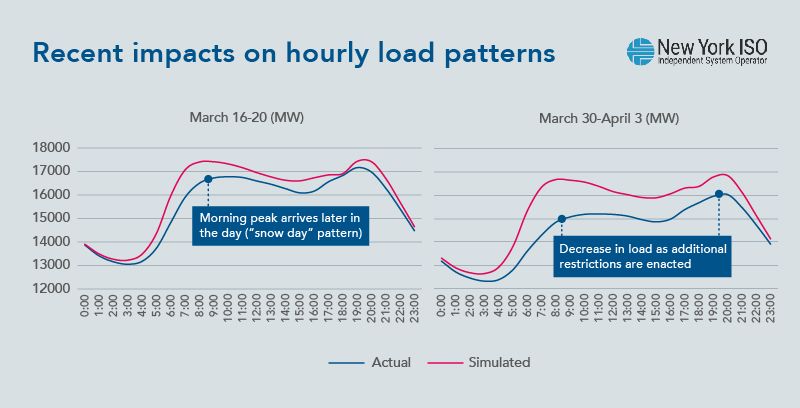

With most of the country covered by stay-at-home orders, we are collectively adjusting to a “new normal,” where more of life is lived at home. In this new world, the distinction between weekday and weekend is blurring, as people, freed from the morning commute and sending kids to school, sleep in later and spend more of the day inside. Within those walls, electricity offers us the semblance of the life we had before, enabling us to work, connecting us to co-workers, friends, and family, and entertaining us with endless hours of binge-worthy shows. Yet, as electricity reminds us of normal life, what’s happening to electric demand is anything but. Our recent analysis provides an indication of how peak demand has changed across the country, raising important questions as we enter the summer season.

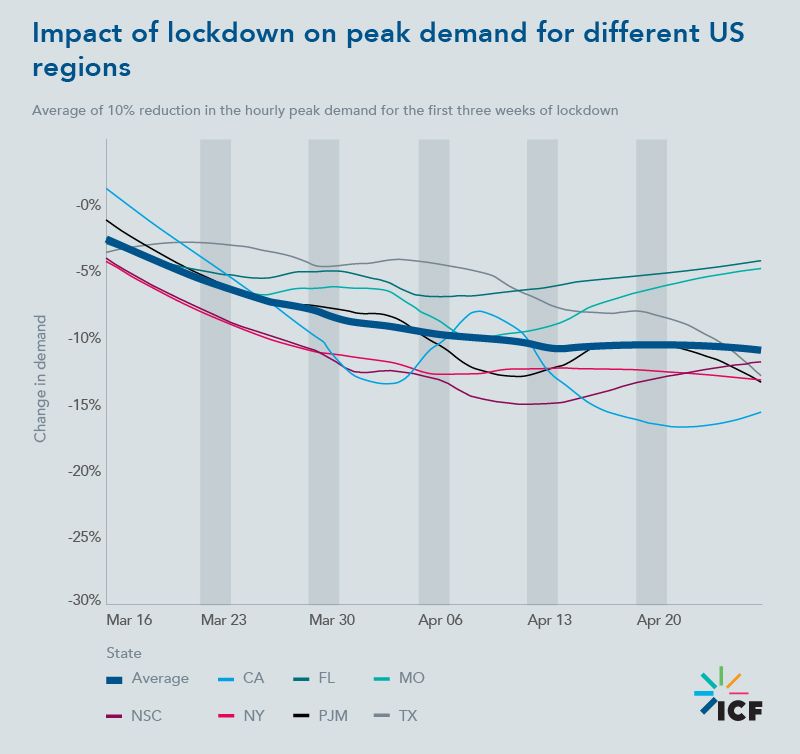

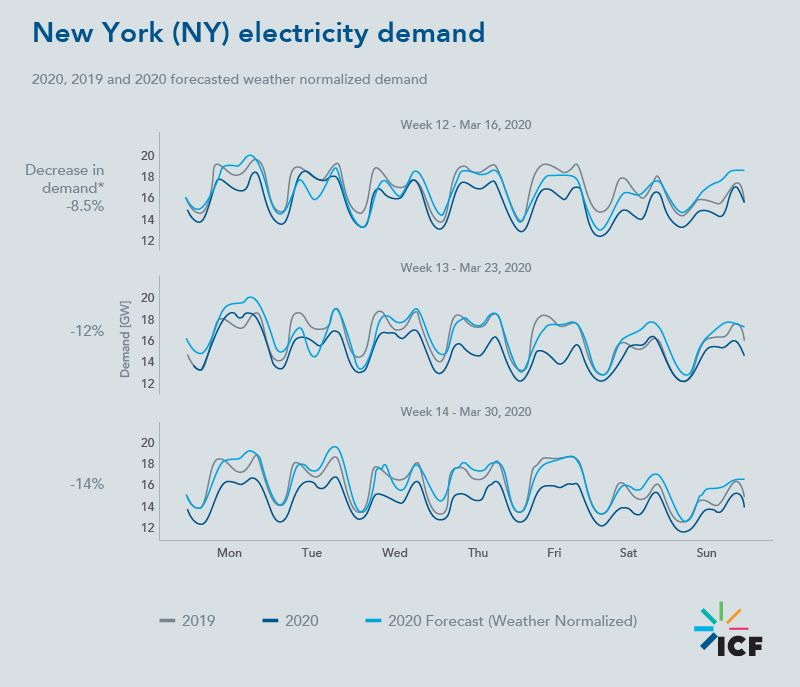

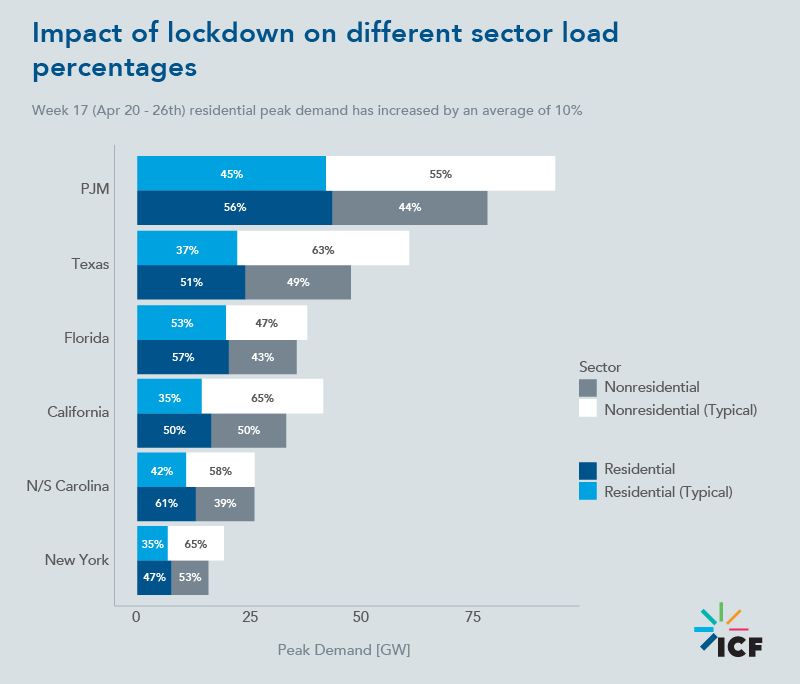

What our analysis shows is that electric demand is dropping, shifting, and still stabilizing. As expected, the drop in economic activity resulting from the closure of many businesses and office buildings and scaling back or shutdown of some manufacturing operations has resulted in a net decline in electric demand. Since the week of March 16, when we started tracking the data, through the week of April 26, we have seen weather-normalized demand fall by between 6% and 21%, with an average decline over the period of 10% across the regions evaluated, as shown in Figure 1 below.

In some states, initial data suggests an almost immediate leveling off, where the variation from week to week is small. However, for many states, it remains to be seen where and when that leveling off will occur, particularly as summer takes hold and we all switch on our air conditioners to keep us cool during hot days at home.

For a system designed to meet peak loads, the assumed reduction in demand may not seem like a problem. However, for a veteran industry that was already coping with massive change, this rapid disruption and lingering uncertainty does raise some important questions, such as:

- Will these trends persist, creating a new normal, for system planners to predict and plan for? For example, the recovery in electric demand from the 2008 recession took almost six months, and even then demand was 2 percent lower than normal conditions.

- How will changes in supply and demand affect grid operations and bulk power markets, particularly if the shutdowns continue into the peak load summer season?

- In the cost of service world of ratemaking, does shifting load require a revisiting of rate structures?

- Faced with declining utility revenues at a time of broader economic challenges, how do we ensure continued investment in the system while protecting customers?