Best practices for CDBG-DR and CDBG-CV economic revitalization programs

HUD's Community Development Block Grant - Disaster Recovery (CDBG-DR) and Community Development Block Grant - CARES Act (CDBG-CV) funds are remarkably flexible. As a grantee, you can use them for a variety of projects including direct awards, training, and/or technical assistance via grants or loans to small businesses.

Because of this flexibility, these programs are important tools for state and local governments looking to recover and rebuild from the economic devastation of COVID-19 or other natural disasters. You have options when designing and implementing economic development, recovery, and revitalization programs. Here we highlight some best practices you should keep in mind.

Disaster tie-back and national objectives

All CDBG-DR and CDBG-CV funds are required to have a tie-back to the qualifying disaster, proving how the activity addresses an unmet recovery need. Grantees must describe the tie-back in the program guidelines with details as to how and where small businesses—or the economy—were impacted. You must also document how each applicant does or does not meet the program’s proof of tie-back requirements.

Economic revitalization projects also allow you to assist small businesses that will help the community and economy recover, even if those businesses were not directly impacted by the qualifying disaster. For example, you can provide a working capital and inventory loan to a new business that wants to open in a vacant building in an impacted commercial corridor or that provides an important service to an impacted community.

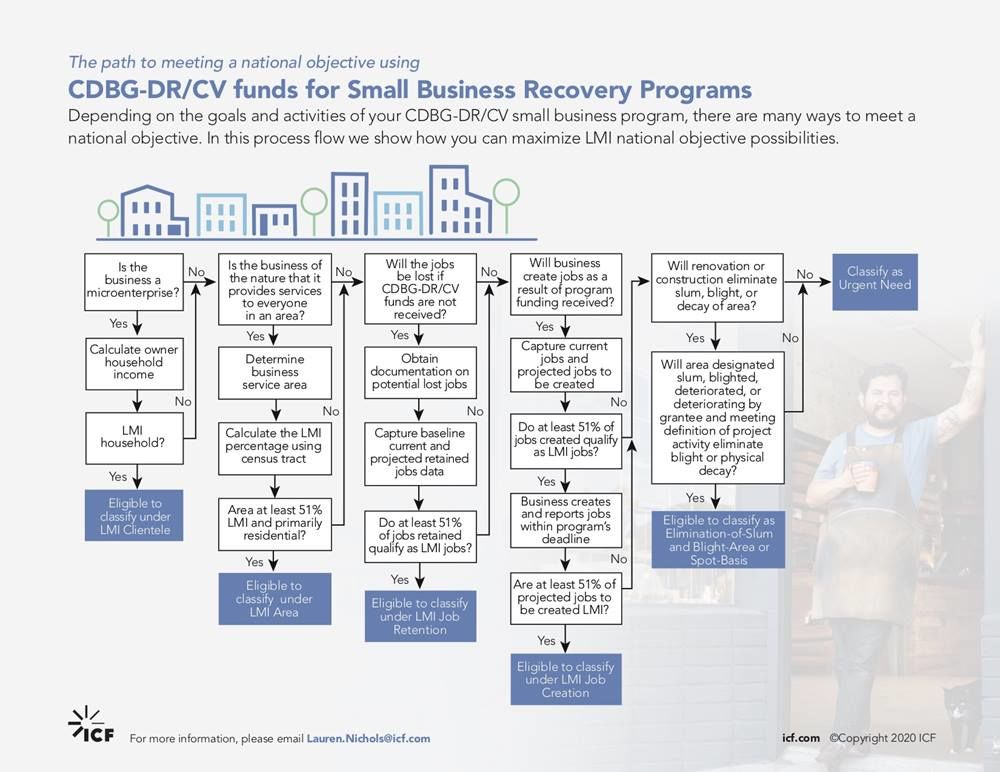

All CDBG funds are required to meet at least one of three national objectives: benefit to low-to-moderate income (LMI) persons; aid in the prevention or elimination of slums or blight; and meet an urgent need. Each CDBG disaster allocation has limitations and alternative requirements associated with meeting those national objectives, so it will be important to know those before designing your programs. You’re required to meet certain LMI expenditure requirements. The programmatic analysis and tie-back may impact which national objectives you include in the program guidelines.

Best practices:

- Create checklists and support documentation requirements for the program’s tie-back requirements so each file is clearly documented.

- Create step-by-step operating procedures, checklists, timelines, and deadlines for each national objective that is allowable in the program. Failure to document how a project meets a national objective may result in recapture of funds.

Eligible uses of funds

CDBG funds are relatively flexible in that you can help small businesses through a wide spectrum of eligible expenses, from working capital to full reconstruction. However, different eligible uses trigger different compliance requirements. Each compliance requirement impacts the timeline, logistics, and costs of these projects.

Best practices:

- Limit CDBG-DR assistance to non-construction activities in order to disburse funding to small businesses as quickly as possible. This can, however, leave a gap in funding for critical business repairs.

- Provide technical assistance and clear communication on timelines, requirements, and potential delays to ensure program transparency for eligible construction costs.

- Work with a HUD representative to include certain types of repairs to commercial structures in the Tier I environmental review, thereby reducing the timeline for environmental clearance.

Underwriting

CDBG-DR and CDBG-CV funds are not subject to the same level of underwriting as private bank or Small Business Association loans. As a grantee, you or your subrecipients must take important steps to ensure federal funds are spent reasonably. HUD provides underwriting guidelines, but you create the practical policies and procedures around those guidelines. You must not duplicate benefits provided to small businesses from another federal, state, local, or subsidized loan for the same purpose.

Awards can be structured as a loan, grant, forgivable loan, or any combination of those award types to help small businesses recover. Each award structure provides pros and cons to recovering businesses and communities. For example, grants and forgivable loans can provide the lower-risk cash that small businesses need to recover, but they must still meet the requirements of the award in order to keep the funds. Loans allow communities to reinvest loan repayments into other businesses that may need help but recovering businesses may be reluctant to take on additional debt.

Best practices:

- Establish program-wide underwriting processes, procedures, and tools to ensure the program is implemented consistently across geographies and eligible applicant categories.

Program implementation

While they may implement these programs directly, both state and entitlement grantees often rely on support from local non-profit organizations—or subrecipients—to help implement these important programs. Experienced, community-based organizations with lending or grantmaking experience may be better positioned to deliver these programs on the grantees’ behalf. Regardless, the grantee is ultimately responsible to HUD for compliance with federal and programmatic requirements, so creating up-front tools for all to follow can mitigate against back-end challenges.

Best practices:

- Assess subrecipients’ capacity upfront through a Notice of Funding Availability in order to identify additional technical assistance, training, and tools needed to provide subrecipients to mitigate risk.

- Provide subrecipients with payment process templates and guidelines for award costs, administration, and activity delivery costs. This will save time and flag any potential ineligible costs for subrecipients and applicants.

- Provide subrecipients with standard operating procedures, regular check-ins, and QA/QC reviews to increase consistency across geographies. This will help subrecipients meet new and complex recordkeeping and compliance requirements.