Fuel-security risks in New England aren't just a forecast, they're already here

The early 2018 storms can tell us a lot about how well gas markets are equipped to meet demand during extreme conditions.

The recent New England ISO (ISO-NE) report on potential fuel-security risks says that the region could see significant levels of emergency actions by 2024/25. Out of 23 possible scenarios, “all but the most optimistic case resulted in load shedding, also known as rolling blackouts …” Key risks identified included “the possibility that power plants won’t have or be able to get the fuel they need to run, particularly in the winter” and the power system’s heavy dependence on liquefied natural gas (LNG).

While the ISO-NE study can be read to imply these risks don’t come to the fore for nearly six years, our review of the recent cold snap implies many of them are already very real.

Winter Storm Grayson Provides a Useful Test

Classified as a ‘bombogenesis’ as a result of its rapid intensification, Grayson brought blizzard-like conditions to much of the East Coast.

Brutal temperatures followed — in Boston, for instance, the average daily temperature fell to just 5 degrees on January 7. Despite its potential (and the loss of 690 MWs associated with the Pilgrim Nuclear Plant), Grayson didn’t spur any significant “emergency actions”, a relief for market participants.

But the story’s not over, and Grayson can tell us quite a bit about why and how risks flagged by the ISO-NE study are already in play.

LNG’s Critical Role

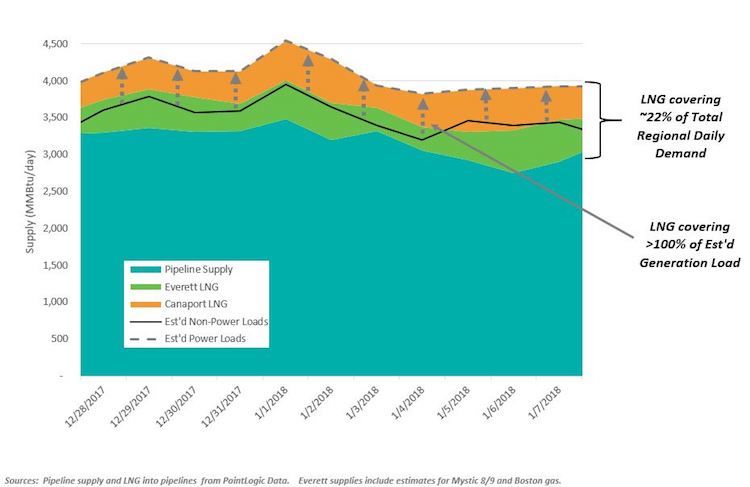

LNG has long been a significant and reliable source of supply for the New England region. Figure 1 highlights this importance by summarizing deliveries from Canaport and Everett into the region over the 11 days of the cold snap. Over this period, these facilities provided an average of over 900,000 MMBtu/day of supply, or nearly 22 percent of total regional daily load. But when compared to power generation requirements, LNG supplies accounted for more than one-hundred percent of the estimated daily need.

Figure 1: Gas Supply Into New England Over Cold Snap

So What’s the Risk?

Long-time participants in the market would correctly note that the Everett facility, in particular, has provided decades of reliable supply to the market. But from a resiliency perspective, LNG is not equivalent to pipeline supply. In particular, LNG is critically dependent on on-site storage capacity and deliveries of incremental supplies during extreme weather events.

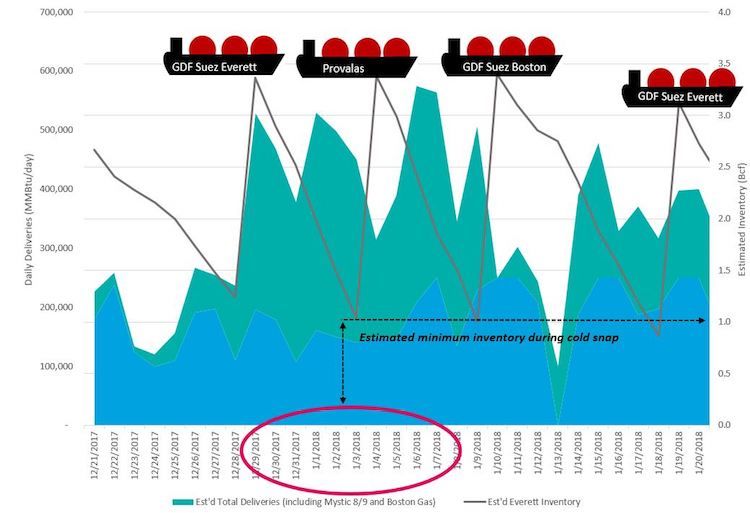

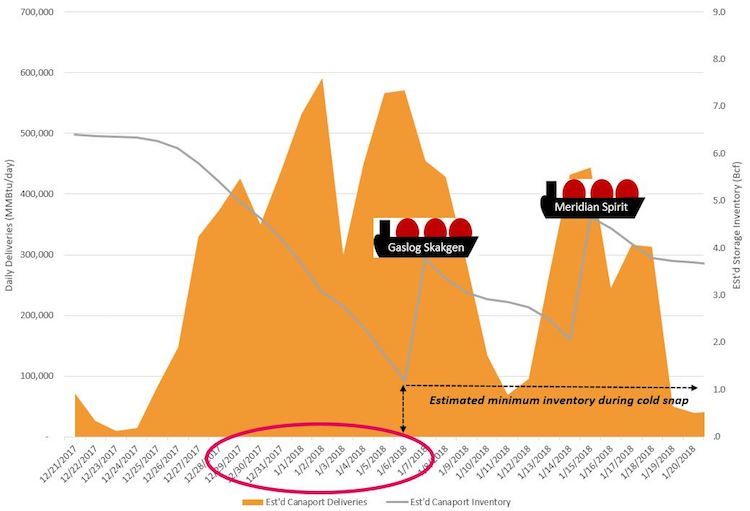

This delivery risk was recently highlighted in January by news that the LNG tanker Gaselys, destined for Everett, reportedly experienced “unfavorable sailing conditions” and arrived eight days late. A look at estimated inventory levels for each facility over the cold snap provides another perspective on this risk. Figures 2 and 3 provide summaries of activity at each facility over the 11 day period, including estimated inventory levels. The key focus here is not the daily quantities delivered to the market, but the inventory level available to meet subsequent generation needs during the critical period.

Estimated inventory levels at Everett regularly fell below 1 Bcf (Figure 2). While this is not overly surprising given its smaller onsite capacity (~3.4 Bcf), this equates to less than two days of inventory based on its estimated sendout over the period. And while Canaport has much more robust onsite capacity (~10 Bcf), the availability of gas is equally based on resupply over critical periods. Inventory at this facility is also estimated to have fallen to below 1 Bcf (Figure 3), again representing only two days of supply at its delivery level.

Figure 2: Estimated Everett Activity

Figure 3: Estimated Canaport Activity

In the Long Run, LNG Is Just Part of the Story

LNG-related risks are not the only ones that market participants should understand, and as highlighted in the ISO-NE study, several trends may be increasing some of these exposures (e.g., push to eliminate oil-fired generation, shutting in of Deep Panuke and Sable Island production). Whereas other factors (e.g., increased renewables) may be reducing annual exposure to gas, but with less clear implications for peak day.