How did the 2017 hurricane season impact holiday travel?

Following the string of hurricanes that devastated the Caribbean earlier this year, millions of U.S. holiday travelers planning trips to impacted island nations and territories have been diverted.

“Travelers who would have been headed to places like Puerto Rico, the U.S. Virgin Islands, and St. Maarten — areas that usually see a marked increase in tourism around the holidays — are booking new flights and accommodations,” said Samuel Engel, global managing director of aviation at ICF.

So how much of a decline did these destinations see? And where are their would-be tourists going instead? New data and analysis from ICF explores the answers to those questions.

How Were Hurricane-Impacted Destinations Affected?

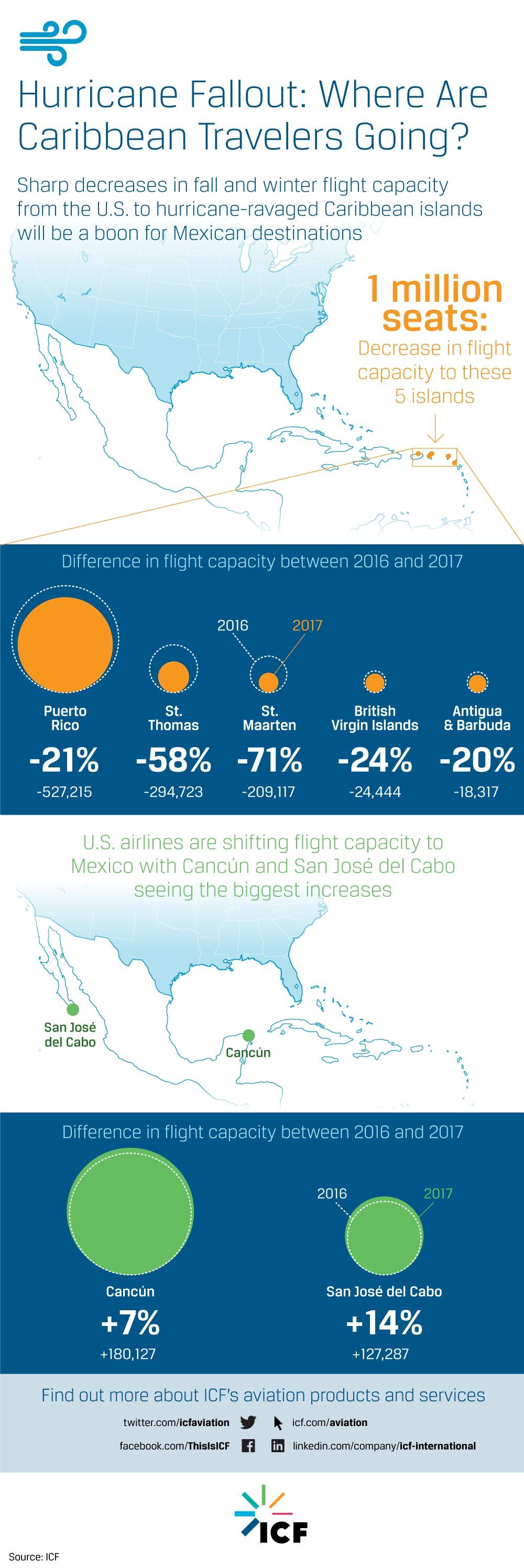

“Unsurprisingly, hard-hit territories and island nations saw a huge drop in travelers from previous holiday seasons,” continued Engel. “St. Maarten (-76.9%), St. Thomas (-69%), and Puerto Rico (-19.6%) lost over a million seats during the winter season (October-March) this year compared to the same period last year.”

Puerto Rico alone lost more than 500,000 seats, a huge blow to the island’s burgeoning travel and tourism industry. According to the World Travel & Tourism Council, travel and tourism in Puerto Rico had grown from 7.3 percent of GDP to 8.4 percent between 2014 and 2017.

Other Caribbean Island nations and territories like Barbados (-21.9%), Curacao (33.6%), the British Virgin Islands (-23.7%), and Antigua and Barbuda (-19.6%) also saw significant declines.

Where Did Travelers Go Instead?

When it comes to vacation alternatives, Mexico leads the pack. Mexico gained over 800,000 seats this season compared to last year (+9.2%). More interesting, however, is that only about half of these seats are headed to traditional resort destinations like Cancun and a comparable number are going to Mexico City.

At first glance, the breakdown seems odd — why wouldn’t these popular vacation spots see a larger proportion of seats? For one, it appears that the Mexican carriers are responsible for most of this growth into Mexico City. ICF experts hypothesize that, given the U.S./Mexico bilateral limits the ability to shift capacity too much, Mexican carriers had to shift their own Caribbean capacity somewhere else. So simply put, Mexican carriers aren’t actually expecting a big demand increase to Mexico City itself, but rather hoping to capture the flow of U.S. leisure traffic over Mexico City hubs to leisure destinations.

Bermuda, The Cayman Islands, Jamaica, and Haiti also gained significant percentage shares. Certain U.S. destinations also saw a significant uptick in seats, including non-Miami Florida destinations like Tampa (+9.7%), Fort Lauderdale (+6.1%), Orlando(+5.6%). Large, coastal cities, especially tech economy hotspots like San Francisco (+7%), Seattle (+6.2%), and Boston (+7.3%), shared in the growth trend.

Check out the below infographic for a visual guide to the analysis.